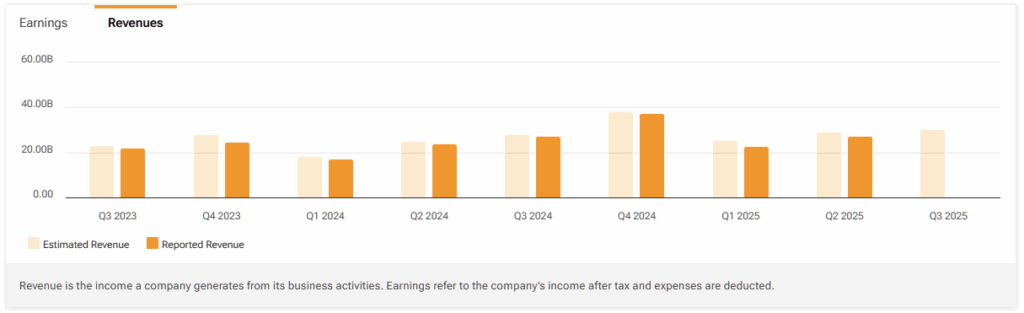

Something quite unexpected happened around twenty days ago: BYD (BYDDF) reported a ~30% year-over-year drop in its Q2 2025 net profit figures — its first major earnings decline since 2021. Growth is still chugging along, but profitability took a hit. The understanding was that EV sales are booming, especially in China. So what’s going on? According to analysts, savage price wars, regulatory pressure, and dealer incentives have forced major manufacturers into profit erosion territory.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BYD stock has declined 17% over the past six months, yet the company remains strongly positioned as a long-term value play, despite the “China discount” and weak sentiment surrounding Chinese equities. However, the stock’s price action post-earnings results has been reassuring.

As Tesla (TSLA) shifts its focus toward autonomous transport and robotics, BYD could realistically emerge as the world’s premier EV brand in the coming years. I remain confidently Bullish, even if my stance on China is somewhat uncertain given the multitude of mixed macro signals.

China EV Price War Forces BYD Into Heavy Discounting

The EV “price war” has been a recurring theme since Tesla’s 2023–2024 price cuts, but it intensified in 2025. In early 2025, Tesla cut prices again on the Model Y and Model 3 in China to defend its share against BYD’s Seal and Dolphin models.

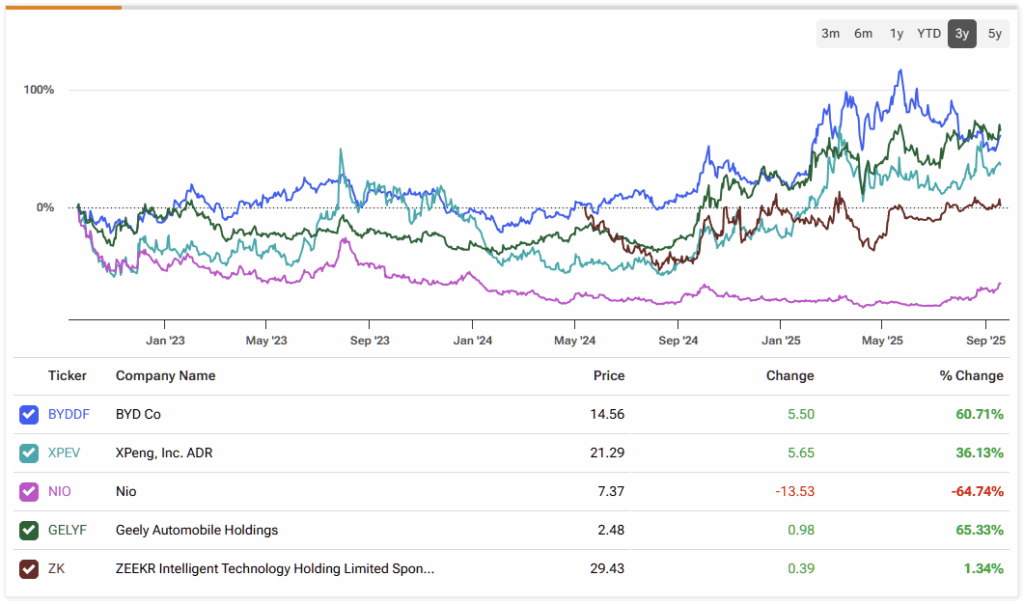

Domestic rivals XPeng (XPEV), NIO (NIO), Leapmotor, Geely Automobile (GELYF), and ZEEKR Intelligent Technology (ZK) also piled on with steeper discounts. In such an environment, BYD has been forced to match lower pricing or risk erosion of its market share.

BYD did respond strategically. The company injected RMB 1 billion in dealer incentives during Q2 to keep inventory moving and avoid sales bottlenecks. However, even with this tactic, its Q2 profit fell by ~30% year-over-year, and the stock price has slumped as a result.

Importantly, BYD and Tesla together command about 40% of China’s NEV market, so they set the tone on pricing. I believe that if Tesla steps back from EVs more aggressively in the next few years, it will significantly alleviate pressure on BYD, allowing it to raise prices and establish a more secure long-term moat. This makes a value investment in BYD very shrewd right now, even if geopolitically sensitive.

On the contrary, Tesla may decide to maintain a strong foothold in the EV space, while BYD remains in a reactive posture. Even as Tesla continues to dominate in humanoid robots and autonomous taxis, which could become its core revenue streams, BYD may remain focused on its own initiatives.

BYD Counters Price Wars at Home with International Growth

Internationally, the EU’s 17% duty on Chinese BYD EVs (through 2029) and the U.S. 100% tariff effectively block market entry unless BYD localizes production, while new plants in Brazil and Hungary help de-risk its cost base and safeguard margins.

This is important because China’s domestic EV market is overcrowded and commoditized, but overseas demand is still in the early stages of adoption (Brazil, Southeast Asia, Europe). International expansion also means that BYD’s margins are no longer solely determined by Tesla’s moves in China. This strategy also aligns with China’s broader goal to become an emerging markets leader, with BYD as one of its primary chess pieces.

According to a BYD SEC filing, the company sees the synergistic effects of technology, scale, and industrialization as advantages, with more new Chinese EVs making their way overseas. According to statistics from the China Association of Automobile Manufacturers, China is expected to export a total of ~6 million cars this year, representing a year-on-year increase of around 10%.

BYD Stock Faces Sentiment Turbulence for Now

In the near term, BYD shares will remain highly sensitive to headlines, with pricing dynamics in China and localization progress taking center stage. Looking 12–24 months out, if management executes on its timelines and shifts the product mix effectively, margins could recover — paving the way for multiple expansions as the current geopolitical discount eases.

Yes, the company faces real operational headwinds, but that’s also what keeps the stock undervalued. As the old saying goes, “buy when there’s blood in the streets” — and this situation fits that logic, at least in part.

Technical Overview

BYDDF’s 14-day RSI sits around 55, signaling neutral sentiment after dipping as low as 30 in August. The stock currently trades just under both its 50-week and 200-week moving averages, offering an attractive entry point from a valuation standpoint — provided you’re not trying to time the market. Some downside volatility is still possible until the stock reestablishes upward momentum.

On fundamentals, BYD still looks undervalued. Its forward P/E (non-GAAP) stands at 16.3x — roughly 10% below the sector median of 18x — while forward diluted EPS growth is forecast at 36%, over five times the sector’s modest 6% median. Valuation alone won’t guarantee outsized returns, as sentiment often dictates near-term moves; however, the discount provides a solid margin of safety and bolsters the long-term investment case.

Geopolitical Drag Keeps BYD Undervalued

I’m not convinced China is the most attractive emerging-markets play at the moment, given its growing divergence from Western leadership. That said, select Chinese equities remain well-positioned, and BYD is one of them. The geopolitical discount is evident in its low valuation multiples relative to growth, but BYD’s potential to become an exceptional investment would likely require a broader policy shift toward Western alignment — something I don’t expect in the near term.

Is BYD a Good Stock to Buy in 2025?

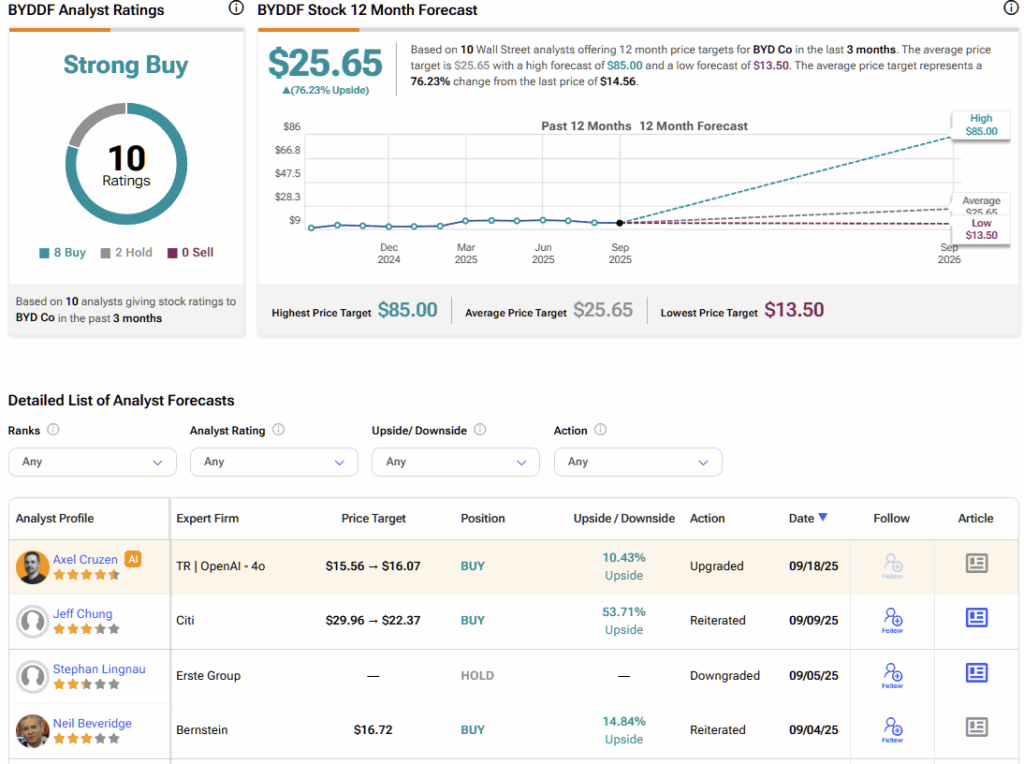

On Wall Street, BYDDF holds a consensus Strong Buy rating, with eight Buys, two Holds, and no Sells from top analysts. The average price target of $25.65 implies a pulse-raising 76% upside over the next 12 months — an outlook that may seem aggressive, but remains attainable under favorable macroeconomic conditions.

BYD Looks Attractive Despite Geopolitical Headwinds

Overall, I view BYD as a strong investment — which is why I own it. While I’m not fully convinced the stock is “cheap” relative to the sector, given the challenging geopolitical backdrop in China, company-specific sentiment paints a more favorable picture. Shares are down nearly 20% from all-time highs, and the RSI signals an attractive entry point. In my view, upside of around 30% over the next 12 months is well within reach.