Blackstone (BX) stock jumped on Thursday after the release of its Q1 2025 earnings report. That’s despite the company’s diluted earnings per share of 80 cents missing Wall Street’s estimate of $1.05. It’s also a 27.9% drop year-over-year from $1.11 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Even with that EPS miss, Blackstone impressed investors with its Q1 2025 revenue of $3.29 billion. That easily beat analysts’ revenue estimate of $2.75 billion, but was down 10.8% from the $3.69 billion reported in Q1 2024. The company noted its strong revenue performance was thanks to $61.6 billion in inflows.

While Blackstone’s Q1 results were mixed, investors were excited about its strong revenue beat. This sent the stock 2.41% higher in pre-market trading today. That follows a 3.12% drop yesterday and helps offset the company’s 24.32% decrease year-to-date.

What’s Next for Blackstone?

Stephen Schwarzman, Chairman and CEO of Blackstone, noted that the company “delivered positive investment performance across all of our major strategies.” He also said BX is “well positioned to navigate the current environment with $177 billion of dry powder to deploy and a resilient, capital-light business model.”

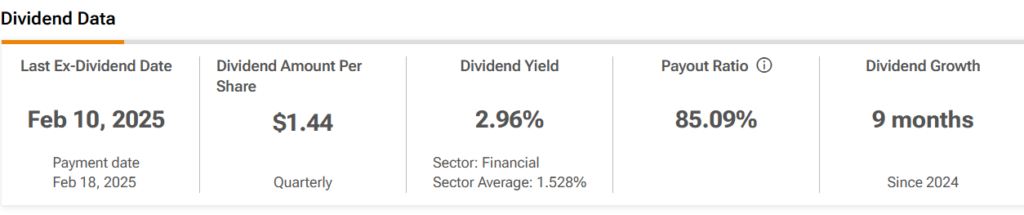

Blackstone also announced a quarterly dividend of 93 cents per share. This will be payable May 5, 2025, to BX shareholders on record when markets close on April 28, 2025. Its previous quarterly dividend was $1.44 and was paid on Feb. 18, 2025.

Is BX Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Blackstone is Moderate Buy, based on nine Buy and eight Hold ratings over the last three months. With that comes an average price target of $158.50, representing a potential 22.24% upside for BX stock. These ratings and price targets will likely change as analysts update their coverage after today’s earnings.