Blackstone (BX) reported strong results in the third quarter. The alternative investment management company posted revenues of $3.66 billion, a surge of 44.1% year-over-year, exceeding consensus estimates of $2.37 billion.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, the firm reported earnings of $1.01 per diluted share, compared to earnings of $0.73 per share in the same period last year. This was above analysts’ expectations of $0.91 per share. Additionally, Blackstone’s assets under management (AUM) ballooned by 10% year-over-year to $1.11 trillion at the end of the third quarter.

Blackstone’s Q3 Results Boosted by Higher Lending Activity

The company’s Q3 results were boosted by higher lending activity. During the third quarter, its credit and insurance business attracted $21.4 billion in inflows, which was more than half of Blackstone’s total inflows across all its businesses.

The strong performance of the credit business helped offset weaker results in private equity and real estate.

According to a Bloomberg report, Blackstone President Jon Gray commented in an interview, “We like having a diversified business.” There is a growing trend among alternative-asset management firms to diversify into the credit business. This trend has made alternative asset management firms more resilient during challenging periods for private equity.

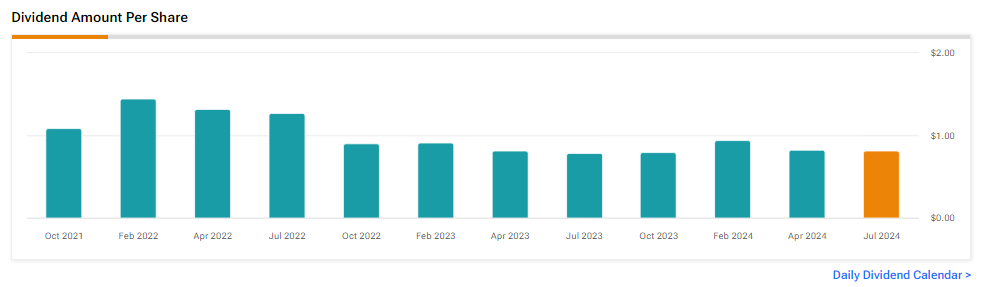

Blackstone Announces Dividend

Additionally, Blackstone raised its quarterly dividend by 5% to $0.86 per share for holders of common stock at the close of business on October 28. The dividend will be payable on November 4, 2024.

Is BX a Good Stock to Buy?

Analysts remain cautiously optimistic about BX stock, with a Moderate Buy consensus rating based on seven Buys, 13 Holds, and one Sell. Over the past year, BX has soared by more than 50%, and the average BX price target of $145.32 implies a downside potential of 9% from current levels. These analyst ratings are likely to change following BX’s results today.