Shares of Blackstone (NYSE:BX) and Ares Management (NYSE:ARES) are two stocks to watch as regional banks aim to boost capital. To provide background, the regional banks in the U.S. are facing stricter rules on regulatory capital requirements. This will push them to enter the SRT transactions. As an increased number of banks enter the SRT space, it will provide solid income opportunities for BX and ARES.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Before we move ahead, it’s worth noting that banks can lower risk and free up capital for other uses through SRTs. In an SRT transaction, a bank keeps ownership of the credit but sells a credit protection agreement. The bank selects a pool of assets on its balance sheet and buys protection. Buyers of these notes get regular payments from the banks.

Usually, banks offer a fixed premium above the Secured Overnight Financing Rate. This makes SRTs appealing to hedge funds and other private credit managers.

SRTs Are Growing

According to a Wall Street Journal report, regional U.S. banks are entering into SRT transactions to offload risk from loan defaults and comply with regulatory requirements.

The report highlighted Huntington Bancshares’ (NASDAQ:HBAN) deal with Bayview Asset Management, which provides a solid income opportunity for the asset management company. Also, other large regional banks, like Ally Bank (NYSE:ALLY) and Truist Financial (NYSE:TFC), are engaging in similar SRT transactions involving billions of dollars in loans.

While these risk transfers help banks protect themselves, they come at a cost and impact their profitability. However, they offer high returns for institutions like Blackstone and Ares Management.

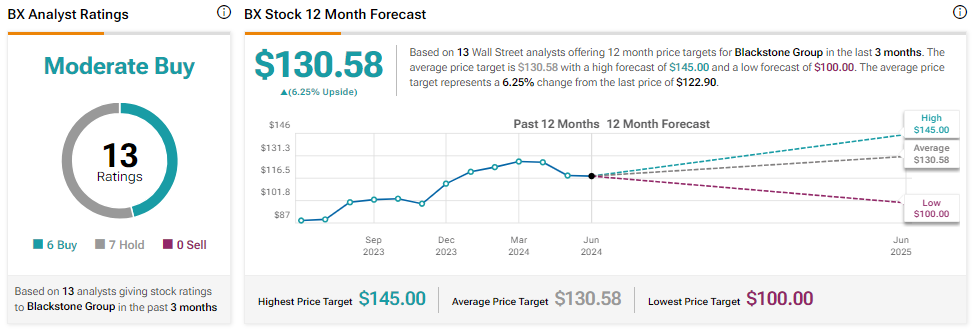

Is Blackstone a Good Stock to Buy Now?

Blackstone stock is up about 40% over the past year. Given this notable increase in share prices, Wall Street is cautiously optimistic about its prospects.

With six Buys and seven Holds, Blackstone stock has a Moderate Buy consensus rating. The analysts’ average BX stock price target is $130.58, implying 6.25% upside potential from current levels.

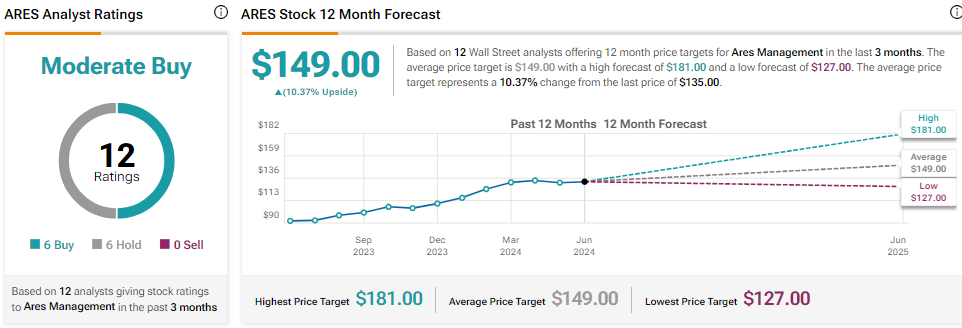

Is Ares a Good Stock to Buy?

Ares Management stock is up about 49% in one year. Wall Street analysts are cautiously optimistic about ARES stock. It has six Buys and six Holds for a Moderate Buy consensus rating.

The analysts’ average ARES stock price target is $149, implying 10.37% upside potential from current levels.