Investment firm J.P. Morgan, led by five-star analyst Doug Anmuth, recently upgraded social media company Pinterest (PINS) from Neutral to Overweight due to Pinterest’s strong progress on its 2023 Investor Day goals. Indeed, the firm believes that Pinterest is delivering on key priorities such as growing its user base while increasing engagement. As a result of the announcement, Pinterest shares rose nearly 5% at the time of writing.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

J.P. Morgan noted that Pinterest is doing a good job of increasing its average revenue per user and running a more profitable business overall. It mentioned that Pinterest has experienced solid growth in monthly active users, thanks to changes that have made the platform more relevant and useful. J.P. Morgan also believes that Pinterest will see stronger profits in the long run by growing revenue faster and keeping costs under control.

In addition, the analysts added that Pinterest is using automation, AI tools, and full-funnel ad strategies, such as Performance+, to capture a larger share of the ad spending market. They also believe that Pinterest is performing well, has room to beat estimates, and is not widely favored by the market yet, therefore making it a good opportunity. Because of these factors, J.P. Morgan raised its price target from $35 to $40, which equates to a 20% increase from current levels.

Is PINS Stock a Good Stock to Buy?

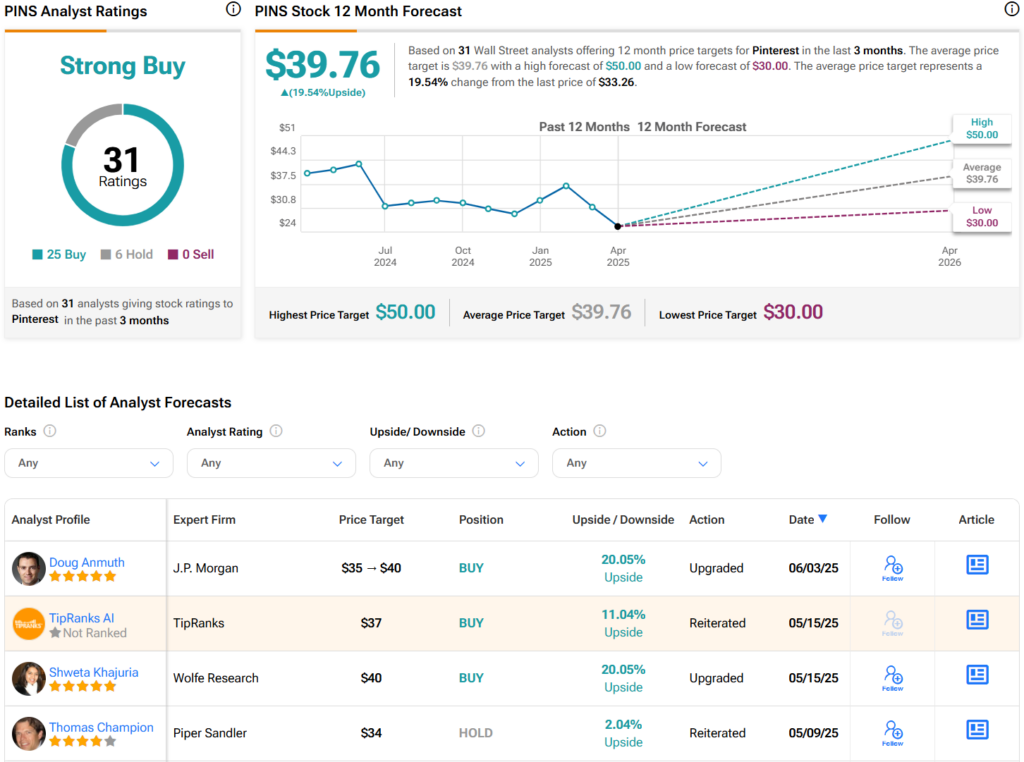

Overall, analysts have a Strong Buy consensus rating on PINS stock based on 25 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PINS price target of $39.76 per share implies 19.5% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue