It’s another day and another major pivot for Cathie Wood‘s ARK Invest line of funds. The funds have moved out of e-commerce tool Shopify (NASDAQ:SHOP) and moved into cybersecurity stock Palantir (NASDAQ:PLTR). The reasons behind the move might surprise some investors, and while Palantir is up fractionally on the news, Shopify is down fractionally.

Multiple ARK funds, including Ark Innovation (NYSEARCA:ARKK), ARK Next Generation Internet (NYSERARCA:ARKW), and ARK Fintech Innovation ETF (NYSEARCA:ARKF), got together and jettisoned shares of Shopify, albeit to different extents. Innovation ditched roughly 126,000 shares, while Next Generation Internet divested over 20,000 shares. Finally, Fintech dropped the lowest quantity at 14,000 shares. The funds then took the cash and ran squarely into Palantir, where Innovation grabbed over half a million shares, Next Generation Internet nabbed roughly 89,000, and Fintech scooped up about 58,000.

Ditching Shopify makes a certain amount of sense; it’s been floundering ever since the COVID-19 lockdowns retracted en masse, and while it’s been making some effort to get its groove back, it’s been a little less than effective now that people aren’t forbidden from setting foot in stores by federal mandate. However, some would question why ARK’s fund collective would pivot into a cybersecurity firm in a time when cybersecurity purchases are getting back-burnered by organizations looking to save cash. One potential reason is just that: sheer potential. While companies might delay cybersecurity purchases, they are likely to come back eventually. Shopify, meanwhile, has been struggling largely since the pandemic broke.

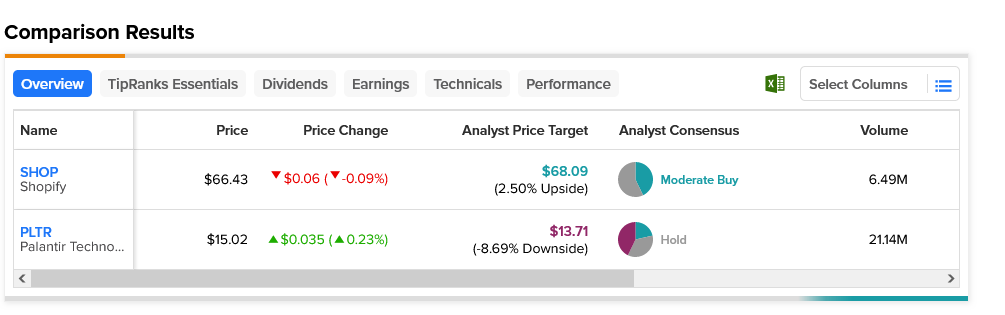

It only gets worse, however, when you look at the two stocks. Shopify is considered a Moderate Buy by analysts, and with a price target of $68.09, boasts only 2.5% upside potential. Meanwhile, Palantir is merely a Hold and, with a price target of $13.71, offers investors 8.69% downside risk.

Questions or Comments about the article? Write to editor@tipranks.com