Shares of off-price retailer Burlington Stores (NYSE:BURL) skyrocketed nearly 19% at the time of writing after investors were impressed with the company’s third-quarter comparable-store sales and full-year financial outlook.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, revenue increased by 12% year-over-year to $2.29 billion. EPS of $0.98 managed to beat expectations by $0.01. Healthy trends in August and September helped the company grow comparable store sales by 6%. In addition, CEO Michael O’Sullivan noted that “November is off to a solid start.”

Moreover, the company’s gross margin improved by 200 basis points to 43.2%. Burlington ended the quarter with $1,440 million in liquidity and a total outstanding debt of $1,412 million. The company repurchased $52 million worth of shares in Q3 and has $718 million remaining under its stock buyback authorization.

For Fiscal Year 2023, Burlington expects revenue to rise by 11% and comparable store sales to increase by 3%. EPS for the year is anticipated to land between $5.52 and $5.67, with 80 net new store openings planned.

For the upcoming quarter, Burlington expects sales to rise in the range of 5% to 7%. Comparable store sales growth is anticipated to be between 0% and -2%. EPS for the quarter is seen landing between $3.04 and $3.19.

Is BURL a Good Buy?

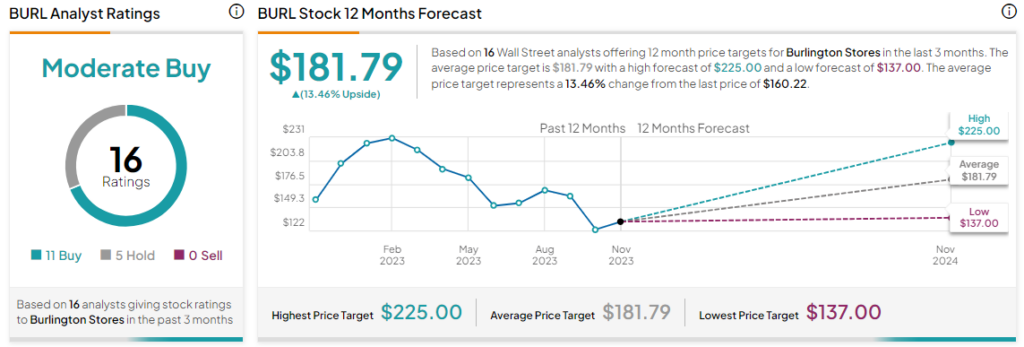

Despite today’s price gains, Burlington shares still remain nearly 34% lower so far this year. Overall, the Street has a Moderate Buy consensus rating on Burlington Stores and the average BURL price target of $181.79 implies a 13.46% potential upside.

Read full Disclosure