Online dating-app company Bumble (NASDAQ:BMBL) failed to impress investors despite generating earnings per share of $0.14 compared to a loss per share of $0.06 in the prior-year quarter and surpassing analysts’ expectations of $0.01 per share. BMBL stock plunged nearly 13% in Wednesday’s extended trading session as Q3 revenue and fourth-quarter outlook missed estimates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Concerns about forex headwinds, product delays, and the impact of lower consumer spending on the Bumble app amid high inflation impacted investors’ confidence.

The company reported revenue of $232.6 million, which increased 16.8% from the previous year but came below the consensus estimate of $237.4 million. Notably, higher revenue from the Bumble App led to the upside.

Moving forward to other key metrics, total paying users at the end of the quarter stood at 3.29 million compared to 2.87 million in the previous year. Further, the average revenue per paying user increased slightly to $22.96.

Regarding the fourth-quarter outlook, Bumble anticipates revenue to be between $232 million and $237 million. The company expects unfavorable foreign currency movements and the Ukraine-Russia war to negatively impact the top line. The guided range is considerably below the Street’s expectations of $253.7 million.

Is Bumble Stock a Buy?

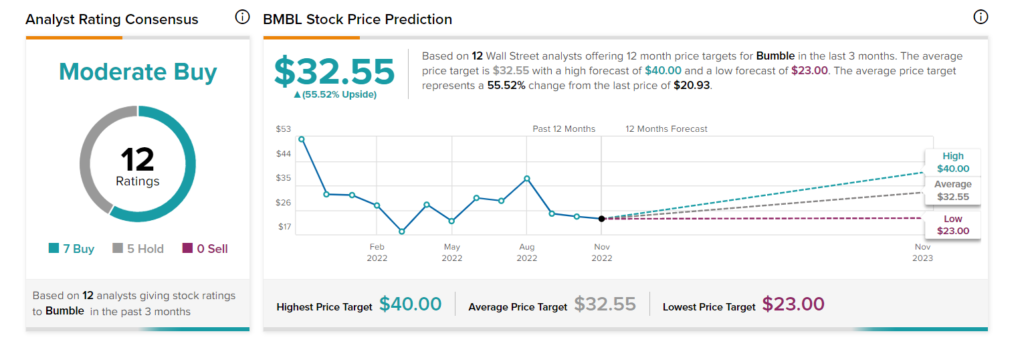

BMBL stock has a Moderate Buy consensus rating based on seven Buys and five Holds assigned in the past three months. The average Bumble price target of $32.55 implies 55.5% upside potential.