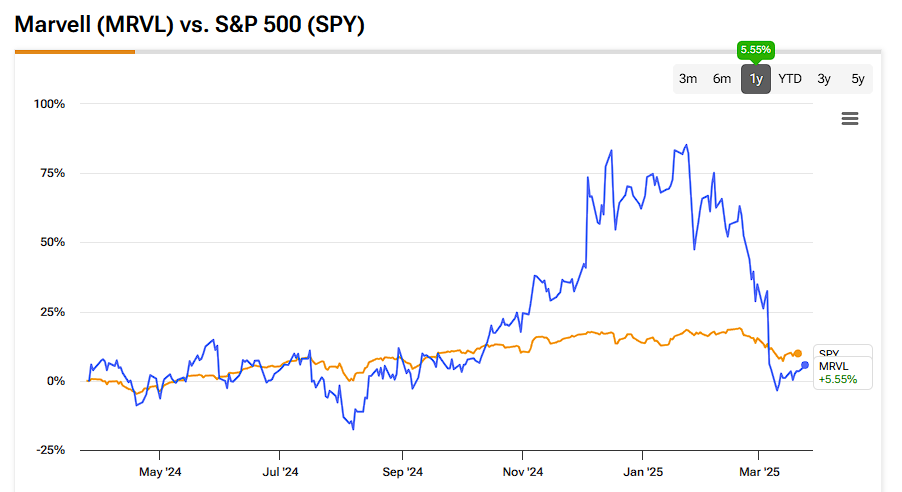

Marvell Technology (MRVL) stock has shed a third of its value over the past month to encapsulate a very anemic start to 2025. The company’s relevance came into question after China introduced a low-cost AI model that doesn’t rely on powerful custom ASICs—Marvell’s specialty. While the company also produces other types of chips, the entire semiconductor industry has been facing a cyclical downturn, with consumers delaying upgrades to their cars and electronics. However, one analyst in particular — Harlan Sur from J.P. Morgan — forecasts ~80% upside on MRVL stock over the coming twelve months.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Despite delivering strong results over the past financial and calendar years, MRVL has failed to gain traction with investors. This seems like a classic case of being in the right industry at the wrong time. As a competitive chipmaker, Marvell plays a crucial role in powering the future, producing semiconductors for data centers, automobiles, consumer electronics, and telecommunication networks.

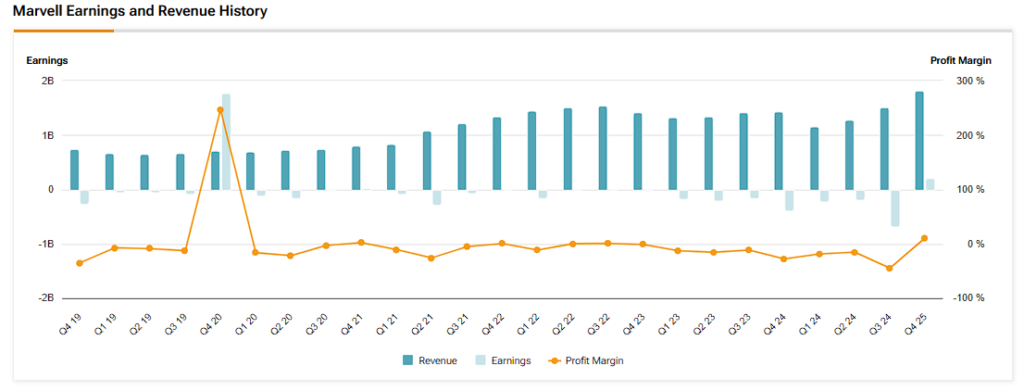

In recent years, profitability has been challenging due to weak demand in non-AI markets. However, with those markets now rebounding and its data center business expanding, Marvell’s outlook has improved. I’m turning bullish at current levels and expect a solid bull run to form over the coming weeks.

What Triggered the Overreaction on MRVL

The recent selloff in MRVL is hardly justified and has created an entry point for long-term investors. Marvell has its set of challenges, as every business does, but I think it can pull through and emerge as a winner. Likewise, I am bullish on the stock and believe its growing popularity among hyperscalers will drive future growth.

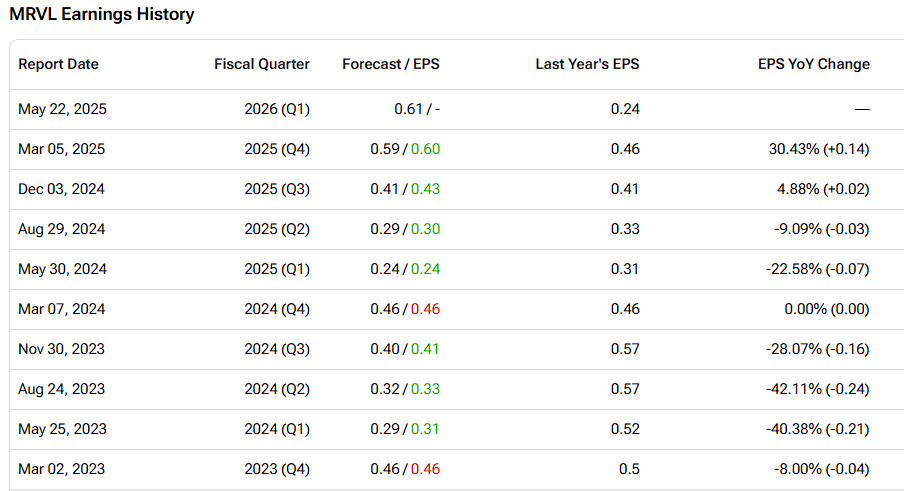

Before delving into the bullish factors supporting the stock, it’s important to allay naysayers’ fears and lay out the root causes for apprehension. For starters, Marvell wasn’t immune to the panic selling triggered by DeepSeek. Additionally, its non-AI end markets are recovering and haven’t fully normalized yet. Management’s guidance of $1.88 billion in sales for the fiscal first quarter of 2026 also failed to impress investors, as it was in line with what analysts at LSEG were expecting.

In my opinion, the DeepSeek-related selloff was just an overreaction. However, the numbers Marvell logged and projected could be worrisome for investors looking for a short-term wealth multiplier. The AI story is still in its early innings, and its legacy business is still a major contributor to its profits. Marvell’s enterprise and carrier markets have suffered in recent years from inventory build-ups, and its consumer-related markets also declined because people paused upgrading their electronics. Nevertheless, the non-AI markets are gradually recovering, and it’s important to note that these declines were not an execution issue. They were primarily driven by the inherent cyclicality of the semiconductor industry.

Marvell’s Data Center Opportunity Should’t Be Overlooked

Marvell’s data center opportunity should not be overlooked simply because the legacy business is struggling. The company has made impressive progress and grew its AI revenue by 88% year-on-year to $4 billion in FY2025. Marvell is working with significant hyperscalers and helping them create custom AI chips for networking and processing.

In April 2024, at its AI day, the company announced securing its third major hyperscaler customer. As of FQ4 2025, it is reportedly working with all four major hyperscalers. While MRVL does not explicitly disclose the names of all four of its customers, it officially announced a five-year collaboration with Amazon’s (AMZN) AWS in December 2024. Under the multi-year agreement, Marvell Technology will supply AWS with custom AI chips and various hardware for data centers.

Marvell’s data center business shows much promise but is not the only player in custom AI chips. It’s much smaller than the kingpin, Broadcom (AVGO). According to estimates from J.P. Morgan, Broadcom commands a market share of 55-60% of the custom ASIC market, while Marvell just holds a 13-15% share. However, Marvell has the potential to grow its share and has been doing just that.

Management projects a data center Total Addressable Market (TAM) of $75 billion by 2028. However, Marvell’s data center business is only 5% of its projected TAM. Therefore, Marvell has a lot of room to run, primarily as it continues to win market share from Broadcom. The market is big enough to accommodate multiple players, and hyperscalers also want to avoid overreliance on one supplier.

Top Wall St. Analyst Expects 85% Upside for MRVL Stock

After earnings, several analysts reiterated their Buy recommendations on Marvell stock but trimmed their price targets slightly. However, some top analysts still see a multi-bagger upside to MRVL stock, including J.P. Morgan’s Harlan Sur, a five-star analyst according to Tipranks’ ratings.

Sur maintained his Buy rating on MRVL stock two weeks ago, citing the company’s strong position in the AI and cloud markets. Sur’s price target of $130 on MRVL suggests an upside of 80% from current levels.

Is MRVL Stock Cheap?

After the sell-off, MRVL stock is trading at a forward P/E of 25x. It’s fairly valued at current levels; however, I suspect some near-term downside. Marvell’s transition to an AI play is not complete yet, and the performance of its non-AI markets still heavily influences how investors feel about the company. I would gradually accumulate shares and buy the stock on every pullback.

I believe Marvell Technology is a long-term winner because it is executing well. It added major new customers and unveiled new products within the custom chips market. Most recently, in March 2025, the company unveiled its first 2nm silicon IP to help develop custom chips for next-generation AI and cloud computing. However, these advancements and Marvell’s progress in the data center vertical will take some time to motivate the consensus sentiment around this stock and offset its legacy business.

I view AI diversification as a future failsafe for the next semiconductor downcycle. Marvell’s business suffered because of its inherent cyclicality, not because of execution missteps. Once the company’s legacy business recovers and its data center business grows, Marvell can power higher.

Is Marvell Technology a Buy, Sell, or Hold?

On Wall Street, MRVL stock carries a Strong Buy consensus rating based on 28 Buy, two Hold, and zero Sell ratings over the past three months. MRVL’s average price target of $117.75 per share implies approximately 64% upside potential over the next twelve months.

Long-Term Outlook Favors MRVL Stock Bulls

In conclusion, the recent dip in Marvell stock has created an attractive entry point for long-term investors. The company’s growth in its data center vertical is promising, with recent contract wins and advancements in custom chips boosting bullish sentiment. At current levels, Marvell stock is fairly valued. However, I expect some near-term volatility to influence investor sentiment and would personally be gradual in building a position and purchase on every pullback.