Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) sold 9.5 million shares of Bank of America (BAC) between October 3 and October 7, reducing its stake to just above the 10% threshold. Interestingly, since mid-July, Berkshire has sold nearly 250 million shares of BAC, generating over $10 billion in proceeds.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the latest SEC filing, Berkshire sold BAC stock in a price range of $39.25-$40.05 per share, for a total transaction value of $383 million. This sale represents the 14th instance of Berkshire Hathaway divesting shares since it began reducing its stake in Bank of America. It is worth mentioning that Berkshire’s remaining stake in BAC is valued at about $31.4 billion, based on Monday’s closing price of $39.96.

With these continued sales, Berkshire’s ownership of Bank of America has dropped to 10.1%. Once its stake drops below 10%, the company will no longer be required to report changes in its position to the SEC within two business days.

Latest Sale Comes Ahead of Q3 Earnings Report

Berkshire’s latest transaction of selling BAC came ahead of its third-quarter earnings, scheduled for release on October 15.

Wall Street expects BAC to report earnings per share (EPS) of $0.77 and revenues of $25.26 billion, reflecting year-over-year declines of 14.4% and 44.3%, respectively.

What Is the Price Target for BAC Stock?

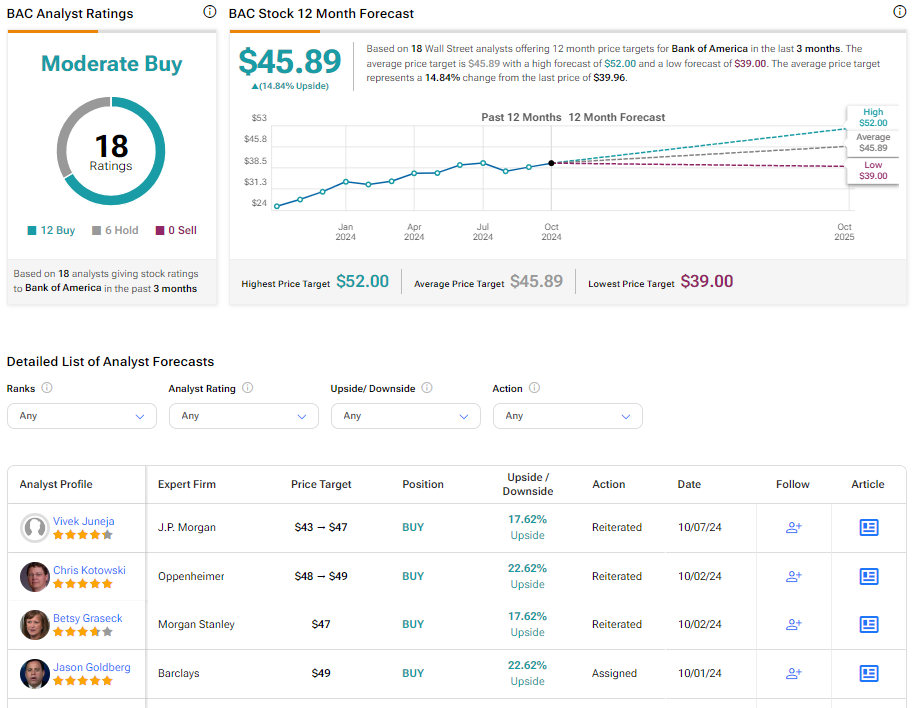

Turning to Wall Street, BAC has a Moderate Buy consensus rating based on 12 Buys and six Holds assigned in the last three months. At $45.89, the average Bank of America price target implies 14.84% upside potential. Shares of the company have gained about 21% year-to-date.