Beer and beverage major Anheuser-Busch (NYSE:BUD) reported a mixed set of numbers for the fourth quarter. The company also managed to avoid a labor strike after reaching a contract agreement with the Teamsters Union.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In Q4, BUD’s revenue increased by 6.2% year-over-year to $14.47 billion. Still, the figure fell short of expectations by $1.46 billion. EPS of $0.82, on the other hand, fared better than estimates by $0.05. The quarter was marked by a decline of 15.3% in BUD’s North American volumes. This drop in volumes led to a 9.5% decline in the company’s U.S. revenue. In Europe, on the other hand, pricing actions led to a mid-single-digit increase in revenues.

For Fiscal Year 2024, BUD expects EBITDA growth to be between 4% and 8%. The company anticipates capital expenditures in the range of $4 billion to $4.5 billion during this period. Additionally, BUD’s Board has proposed a dividend of €0.82 for the full year 2023. The dividend remains subject to shareholder approval at the company’s annual meeting in April.

Separately, BUD has avoided the specter of a labor strike by reaching a deal with the Teamsters. The tentative five-year deal involves higher wages, an increase in vacation days, and other benefits.

Is BUD a Good Stock to Buy Now?

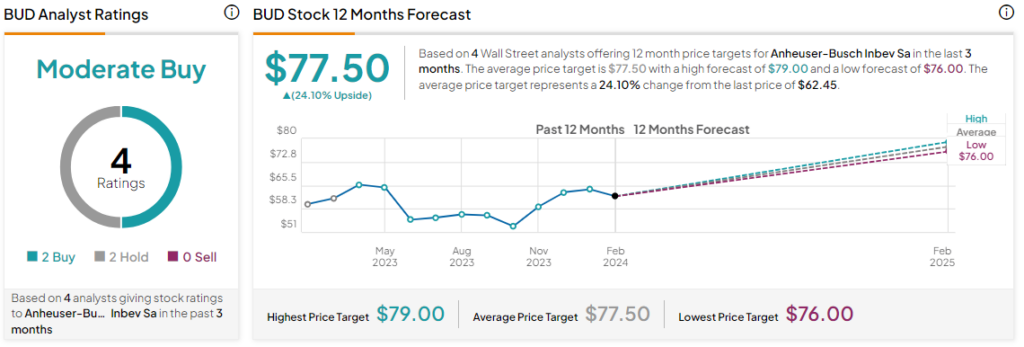

BUD’s share price has steadily inched up by nearly 8% over the past six months. Overall, the Street has a Moderate Buy consensus rating on Anheuser-Busch alongside an average price target of $77.50. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure