Nvidia (NASDAQ:NVDA) investors have seen shares slide by 12% this year, an unusual occurrence for a stock that has been a consistent high-flyer in recent years.

Yet, you wouldn’t have sensed any concern at GTC 2025. For two and a half hours, Jensen Huang owned the stage, delivering a keynote packed with ambition and confidence. And as Cowen analyst Joshua Buchalter put it, despite the broader market’s jitters, there were “few signs of the skepticism that pervades the tech tape.”

“No major surprises,” the analyst went on to say, “the roadmap was extended and details were filled in. That said, NVIDIA still flexed its scale and breadth that has made it the clear AI leader.”

As expected, the chip giant officially introduced the Blackwell Ultra platform, slated for release in the second half of the year. This launch follows the ongoing rollout of the current Blackwell platform, which Nvidia said is “in full production” and experiencing “incredible” demand. So far this year, the company has shipped 1.8 million units (counting two GPUs per Blackwell shipment) to its top four cloud service provider (CSP) customers – outpacing the 1.3 million Hopper units shipped throughout all of 2024.

“This not only shows the health of the Blackwell ramp, but also shows the relatively surprising diversity for Hopper, as we estimate the company potentially shipped ~4M units in 2024,” Buchalter commented.

Roadmap-wise, Vera Rubin is set for a release in 2H26, followed by Rubin Ultra in the second half of 2027 and Feynman in the second half of 2028. “Importantly,” Buchalter added. “We think NVIDIA did not de-emphasize the rack-level solutions despite investor concerns on NVIDIA and the industry’s ability to ramp these complex systems.”

The company also showcased its extensive range of “vertical AI offerings,” highlighting key partnerships. Management announced a collaboration with GM for its next-gen AV software, along with a suite of telecom partners to develop AI-powered 6G RAN, the next-generation wireless network infrastructure that will support 6G technology.

Looking at the big picture, Buchalter thinks it’s interesting to see how Nvidia talks about (and shows) the effects of reasoning models and the choices involved in how reasoning works, especially when considering different ways AI can grow. In the evolution of AI, Buchalter believes we’re still in the early stages of generative and reasoning AI. Meanwhile, physical AI is mostly limited to “simpler applications and likely still too early to meaningfully enter the investor narrative.”

If you’re going to bet on one company making the most of this opportunity, then according to the analyst, Nvidia fits the bill as “the leader in accelerated compute.”

“Longer term,” Buchalter summed up, “NVIDIA’s reputation for offering superior technology, long pedigree of fearless innovation, and extensive growth-oriented investments should allow for material, above-peer growth across its full-stack compute platforms.”

Backing up his bullish stance, Buchalter rates NVDA shares a Buy, with a $175 price target—suggesting the stock could climb ~49% in the months ahead. (To watch Buchalter’s track record, click here)

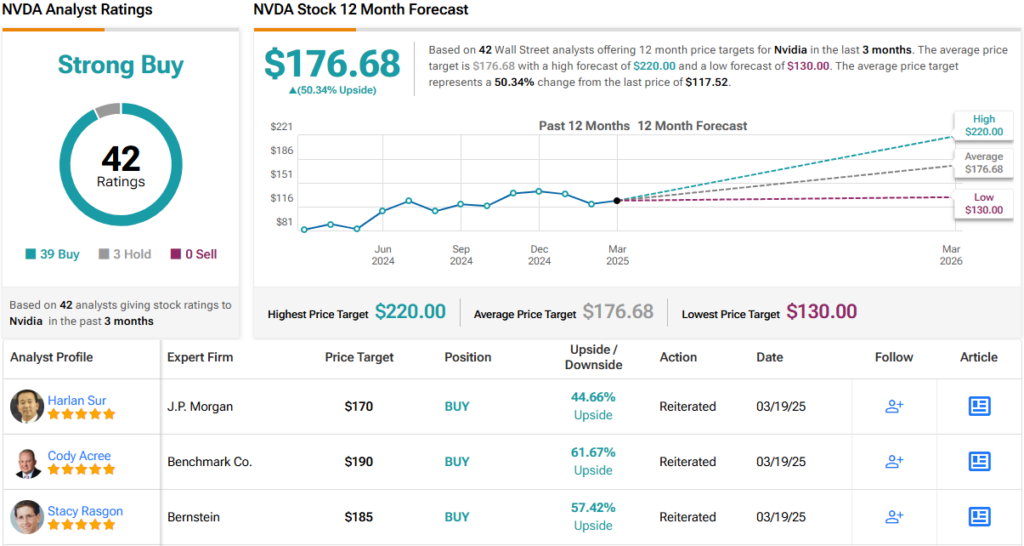

The Street’s average target is just a touch higher; at $176.68, the figure makes room for one-year returns of 50%. Based on a lopsided 39 Buys vs. 3 Holds, the analyst consensus rates the stock a Strong Buy. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.