Robinhood Markets (HOOD) has launched new micro futures contracts in the U.S. for cryptocurrencies such as Bitcoin (BTC), Solana (SOL), and XRP (XRP).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new micro futures contracts expand the online brokerages’ crypto offerings for its nearly 26 million funded accounts. Micro contracts require less collateral than full-size futures contracts, letting retail investors place bets on the future price movements of cryptocurrencies while committing less capital.

The contracts also allow investors to hedge their current positions regardless of their size. This latest move from Robinhood comes after the exchange launched full-blown futures contracts for Bitcoin and Ethereum (ETH) in January of this year.

Recent Acquisitions

The micro futures contracts also come weeks after Robinhood closed its $200 million purchase of Bitstamp and finalized a $179 million deal to buy Canada’s WonderFi. Robinhood’s data shows that crypto trading volumes on its platform have exploded in recent months.

In May of this year, the value of cryptocurrency trading on Robinhood’s platform reached $11.70 billion, representing a 65% year-over-year increase. HOOD stock is up 144% this year and has been one of the best-performing securities in the first half of 2025.

Is HOOD Stock a Buy?

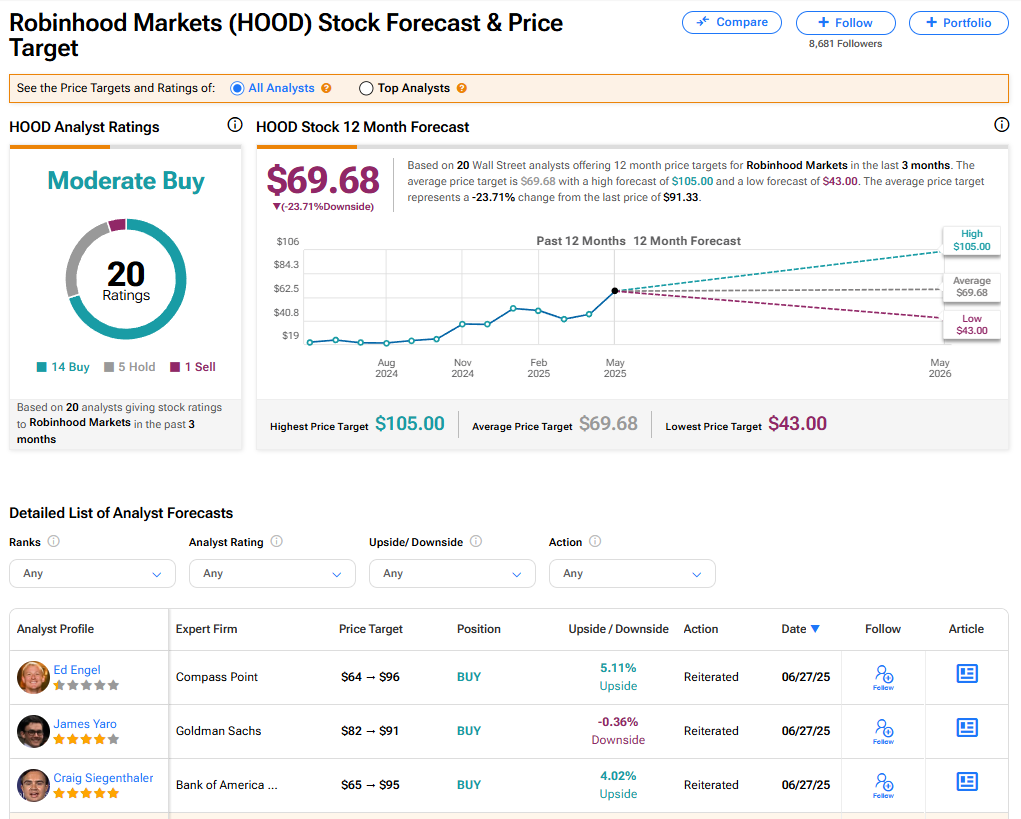

The stock of Robinhood Markets has a consensus Moderate Buy rating among 20 Wall Street analysts. That rating is based on 14 Buy, five Hold, and one Sell recommendations issued in the last three months. The average HOOD price target of $69.68 implies 23.71% downside risk from current levels.