Bitcoin’s dip below $75,000 didn’t last long. The world’s biggest cryptocurrency clawed its way back to nearly $80,000 late Monday, pulling up major tokens like XRP (XRP-USD) and Dogecoin (DOGE-USD) along the way. The move helped the total crypto market cap bounce back to levels not seen since early November—just after Trump’s election win sent prices ripping through resistance.

Altcoins Bounce as Traders Reset Risk

XRP, Dogecoin, BNB (BNB-USD) and Cardano’s ADA (ADA-USD) all jumped as much as 10% in the recovery. A big chunk of the rebound was technical. More than $1.3 billion in crypto futures were liquidated on Monday, with most of the pain hitting long positions. That shakeout cleared out overleveraged traders, setting up room for a bounce.

In a note shared with CryptoRank.io, futures data provider CoinGlass confirmed that Bitcoin long liquidations alone topped $392 million. Ethereum and XRP followed closely behind, adding to the total.

Analysts Debate Whether This Is a True Reversal

There’s still disagreement over what comes next. Alex Kuptsikevich, chief market analyst at FxPro, told CoinDesk the market looks “emotionally oversold,” but warned that “the catalysts required for it to be a reversal are not yet in place.” He added that sentiment has sunk into “extreme fear,” but that doesn’t necessarily mean confidence is returning. Jupiter Zheng, partner at HashKey Capital, echoed a more optimistic view in the same report, saying “we’re optimistic that investors seeking safe havens may look to buy the dip on Bitcoin” if it continues to hold ground against equities.

Bitcoin’s Safe Haven Status Faces New Test

Bitcoin’s claim to be a “digital gold” is facing another reality check. Unlike traditional safe havens like gold, which tend to rise during market chaos, Bitcoin has recently traded more like a high-risk tech stock. During last week’s equity sell-off, it dropped right alongside the S&P 500—raising fresh doubts about its reliability when things get rocky. According to a peer-reviewed study in ScienceDirect, Bitcoin failed to act as a safe haven during the 2020 COVID crash, moving almost in lockstep with equities rather than counter to them.

Recent data suggests that trend hasn’t changed much. A report from FTSE Russell showed Bitcoin’s correlation to risk-on assets like tech stocks has strengthened over the past few years. That’s made it harder to argue Bitcoin behaves like a defensive hedge during market stress. Instead, it seems to track investor sentiment—going up when risk appetite is high, and falling when fear takes over.

Still, some Bitcoin bulls aren’t backing down. They argue its fixed supply and decentralised nature make it a long-term inflation hedge—even if it doesn’t act like one in the short term. That narrative is sticking with investors looking for protection against fiat currency debasement.

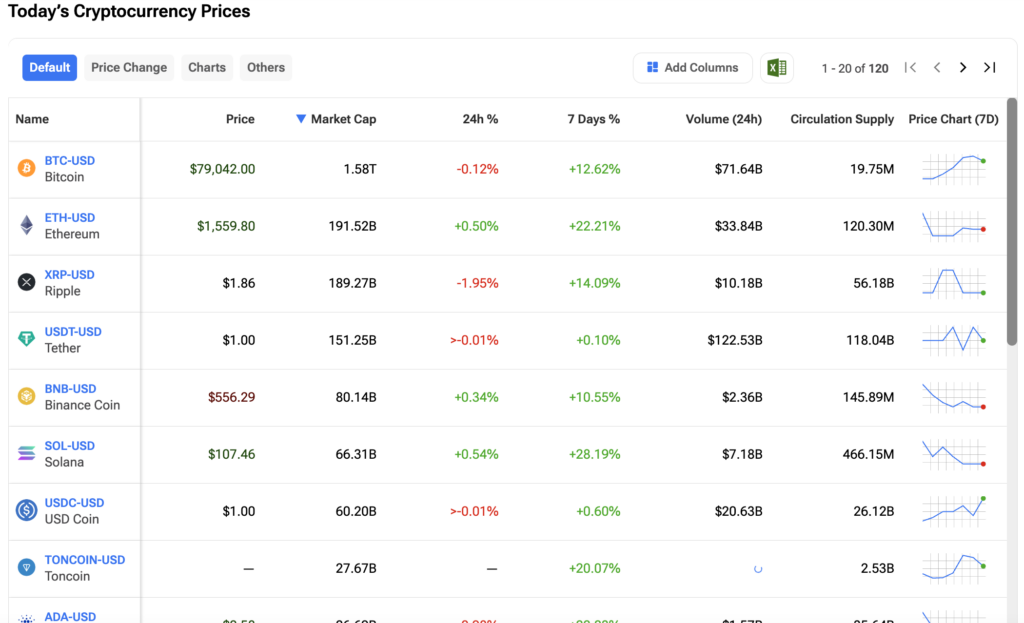

If you’re trying to keep up, you can track real-time crypto price swings, explore technical analysis, and use tools built to help you monitor your favorite tokens on the TipRanks Cryptocurrency Center. Click on the image to find out more.