Braze (NASDAQ:BRZE) stock gained about 15% in yesterday’s extended trading session after reporting stronger-than-expected results for the first quarter of Fiscal 2025. The company’s customer base grew by 13% in Q1, contributing to its strong performance. Buoyed by strong results, BRZE raised its full-year revenue guidance.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Braze is an American cloud-based software company.

BRZE: Q1 Highlights

The company’s adjusted net loss per share of $0.05 compared favorably with a loss of $0.13 in the year-ago quarter. Also, it surpassed the Street’s estimate of a loss of $0.10. Meanwhile, Q1 revenues increased 33.1% to $135.5 million and beat analysts’ expectations of $131.7 million. The top-line growth was supported by a 34% increase in subscription revenues.

Regarding a key performance metric, remaining performance obligations (the total value of contracted products yet to be delivered) of $657.3 million increased from $477.5 million in the prior year quarter.

Strong Outlook

For Fiscal 2025, BRZE now expects revenue to come between $577 million and $581 million, up from previous expectations of $570 million to $575 million. It reflects a growth of 22.2% to 23.1% from Fiscal 2024. Also, the company forecasts that the adjusted loss will be in the range of $0.06 to $0.1 per share.

For the second quarter, Braze anticipates that revenue will fall between $140.5 million and $141.5 million, up 22% to 23% year-over-year. Moreover, the company expects the adjusted loss to come in the range of $0.03 and $0.04.

Is Braze a Good Stock to Buy?

Overall, Braze has a Strong Buy consensus rating based on 16 Buy and one Hold recommendations. The analysts’ average price target on BRZE stock of $62.50 implies an upside potential of 69.93% from current levels. Shares of the company have declined by 31% year-to-date.

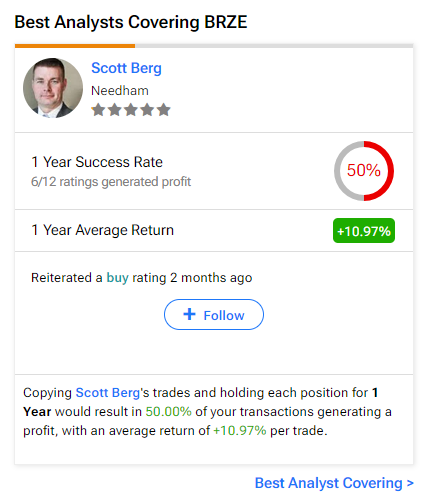

Interestingly, investors considering Braze stock could follow Needham analyst Scott Berg. He is the best analyst covering the stock (in a one-year timeframe). He boasts an average return of 10.97% per rating and a 50% success rate. Click on the image below to learn more.