Brookfield (BN), a major private equity firm, is entering the AI cloud space, according to The Information. More specifically, instead of just owning the land and power infrastructure around data centers, Brookfield will now lease AI chips directly to developers through its new cloud company, Radiant. This move is backed by a $10 billion AI fund and ties into Brookfield’s $100 billion plan to acquire land, data centers, and energy assets for AI computing. According to the firm, the goal is to reduce the cost of developing AI by controlling everything from chips to power.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

To support this strategy, Brookfield is building data centers in France, Qatar, and Sweden. In addition, Nvidia (NVDA) is helping Brookfield set up large server clusters and has invested in the private equity firm’s AI Infrastructure Fund. Notably, Brookfield will give priority to its own cloud company when leasing the data centers, though it may also lease to external providers. The firm is also investing in fuel cell technology and nuclear power (via Westinghouse) in order to help meet the energy demands of its data centers.

Interestingly, Brookfield sees strong demand from governments and companies that want more control over where their data is stored. Moreover, executives stress that Brookfield invests only when demand is confirmed, not speculatively. As a result, they hope to lower AI cloud costs through innovative business structuring, which, when combined with potentially cheaper future technology, could accelerate AI adoption at scale.

Is BN Stock a Good Buy?

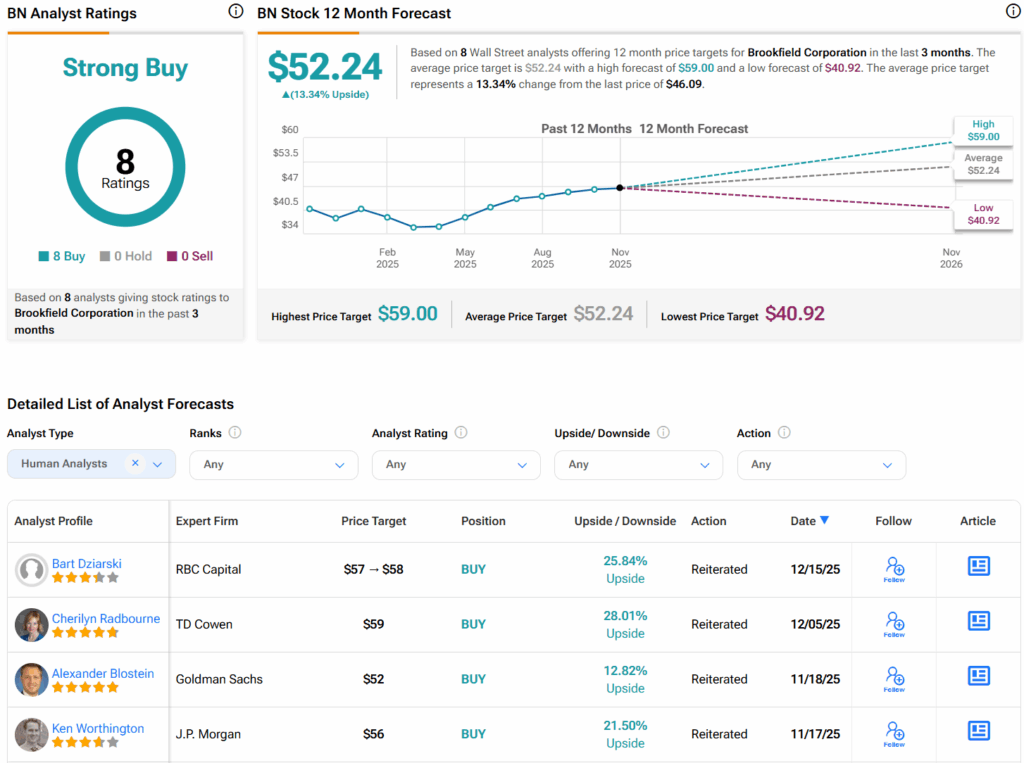

Turning to Wall Street, analysts have a Strong Buy consensus rating on BN stock based on eight Buys assigned in the past three months, as indicated by the graphic below. Furthermore, the average BN price target of $52.24 per share implies 13.3% upside potential.