Many investors are considering investing in either AI-enabler Broadcom (AVGO) or CPU-maker Intel (INTC). Both have alluring features and both also have room for concern.

In my view, Broadcom is a better long-term investment than Intel, but Intel’s current valuation makes it a more attractive short-term buying opportunity. I’m bullish on Broadcom long-term but bearish in the short term, and vice versa for Intel.

Looking at both stocks’ five-year market performance, it’s clear that Broadcom has outperformed. However, I still think Intel’s performance over the next few years will be more dependable than Broadcom’s, especially for shareholders.

Broadcom CEO Creates Long-Term Value

Broadcom is among today’s most formidable tech investments, driven by its hybrid semiconductor and enterprise software model. Hock Tan, the company’s pioneering CEO, is known for ruthless cost efficiency, high-margin acquisitions, and disciplined capital allocation. Under his leadership, Broadcom has become a cash flow powerhouse, with free cash flow growing nearly 30% annually over the past decade. Tan’s the main reason I’d be bullish on Broadcom if it was fairly valued.

Hock Tan became CEO of Avago in March 2006. In 2015, Avago acquired Broadcom and adopted its name. Since its 2009 IPO at $15 per share, Broadcom shares have surged 12,400%, while Intel shares have gained just 7.5% in the same period.

At first glance, Broadcom seems like the better investment. However, in the short term, Intel is the more attractive opportunity due to its valuation.

Intel Stock is Trading at Bargain Levels

I’m bullish on Intel in the short term because it’s undervalued due to its current operational weakness. Intel was once the undisputed leader in semiconductors, but competition is fierce. NVIDIA (NVDA) and AMD (AMD) dominate AI and GPU chips, leaving Intel behind. Even Apple (AAPL) ditched Intel for its own M1/M2/M3 chips.

To turn things around, Intel is shifting to a vertically integrated model and investing heavily in chip manufacturing. However, TSMC (TSM) is far ahead with better infrastructure and loyal customers, making it challenging for Intel to compete.

Adding to the uncertainty, CEO Pat Gelsinger was recently ousted, leaving the company in a fragile position. However, distressed companies can present significant investment opportunities, making Intel a short-term investment at bargain levels with plenty of upside to endure.

Intel Paves the Way for Short-Term Buying Opportunity

Focusing on a three-year period is ideal when valuing Intel, as this timeframe is sufficient to benefit from the value trade. I estimate Intel will generate $60 billion in revenue by the end of FY2027. With 3.95 billion shares outstanding due to ongoing buybacks, this translates to about $15.20 in revenue per share.

By then, Intel is likely to trade at a price-to-sales (P/S) ratio of 2 or higher, given its five-year average P/S ratio of 2.55 compared to the current 1.55. The company is expected to enter a profit-harvesting phase in FY2026 and 2027, boosting investor sentiment.

At a P/S ratio of 2 and revenue per share of $15.20, Intel’s stock price would reach $30.50 by FY2027. The current stock price languishing at $19.70 per share represents a potential upside of 55% over three years.

What Does Wall Street Say About Intel?

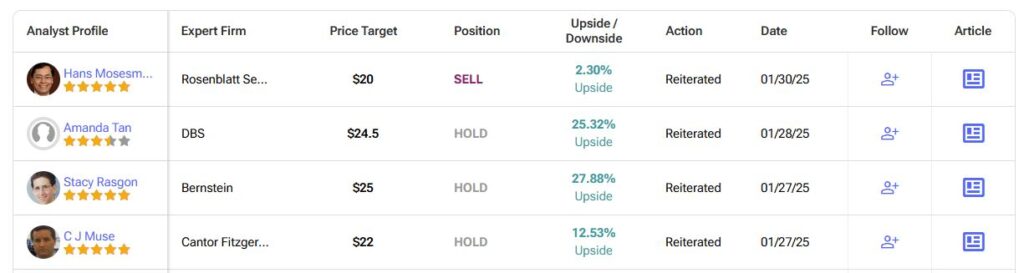

Wall Street analysts currently rate Intel as a Hold, with one Buy, 23 Hold, and four Sell ratings issued over the past three months. The average INTC price target of $23.58 suggests a 21% upside over the next year, offering better return potential than Broadcom.

I am more optimistic, expecting the stock to reach around $27 within a year if the market raises its valuation ahead of anticipated strong earnings.

Everyone Wants a Piece of Broadcom

I believe Broadcom shares are too expensive right now, so I’m waiting for a price drop before considering an investment and remain neutral on the company’s stock until then.

Over the past three years, Broadcom’s earnings per share (excluding non-recurring items) have grown by 20.3% annually. However, Wall Street expects only a slight improvement to 21.7% per year over the next three years. This slight difference doesn’t justify the current high valuation.

Broadcom’s P/E ratio (excluding non-recurring items) is 42.5, far above its five-year median of 19. This disconnect isn’t justified by future growth prospects.

Much of the valuation surge comes from AI hype rather than fundamentals. Once the AI euphoria fades in a few years, Broadcom could face a significant stock price drop, leaving shareholders vulnerable.

What Does Wall Street Say About Broadcom?

Wall Street analysts consider Broadcom a market darling and a Strong Buy, with 23 Buy, three Hold, and zero Sell ratings assigned over the past three months. The average AVGO price target is $236.29 per share, suggesting around 7.5% potential upside over the next year.

The lowest analyst estimate is $160, and I believe a price below $200 is more likely by January 2026 if the market starts pricing the stock closer to its justified value.

Great Investments Come at a Steep Price

Broadcom is a superb addition to anyone’s portfolio, but adding it now may not be prudent. The stock’s current valuation is too high, making this a bad time to buy. In contrast, Intel is undervalued despite recent challenges, creating a good opportunity for a short-term value trade with an option for more.

Both AVGO and INTC are great tech stocks with the right exposure to the right markets at the right time. However, only one should be considered a Buy, given current valuations and market conditions.