Leading insurance provider Brown & Brown (BRO) has posted fourth-quarter 2024 financial results that beat Wall Street forecasts on the top and bottom lines.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Florida-based company reported Q4 earnings per share of $0.86, which beat the consensus estimate among analysts that called for $0.77. Revenue in the quarter totaled $1.20 billion, which was ahead of expectations for $1.12 billion.

“The fourth quarter was outstanding. We are extremely pleased with our 10.4% organic revenue growth for 2024. These results were only possible through the incredible efforts of our 17,000+ teammates,” said Powell Brown, CEO of the company, in the earnings statement.

Continued Growth

Brown & Brown noted that its Q4 2024 revenue grew 15% from a year earlier, while its earnings for the quarter rose 25%. Revenue for all of 2024 increases 12.9% to $4.8 billion, and the company’s margins improved to 35.2% from 33.9% in the previous year.

Brown & Brown, which is the fifth largest independent insurance brokerage in the U.S., specializes in risk management, a hot topic right now given the wildfires raging around Los Angeles, California and the significant damage to properties in that state. The company has more than 450 locations worldwide.

BRO stock has risen 40% in the last 12 months.

Is BRO Stock a Buy?

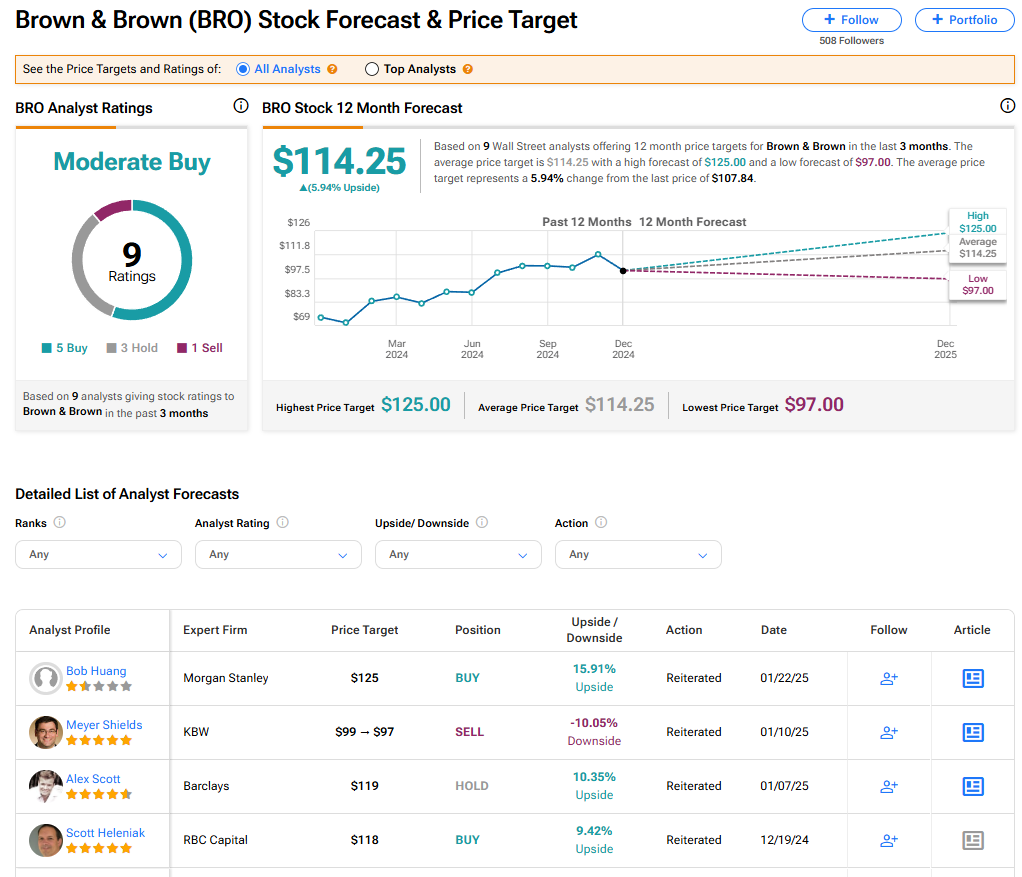

Brown & Brown stock has a consensus Moderate Buy rating among nine Wall Street analysts. That rating is based on five Buy, three Hold, and one Sell recommendations made in the last three months. The average BRO price target of $114.25 implies 5.94% upside from current levels. These analyst ratings are likely to change following today’s results.