Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B) delivered upbeat fourth-quarter results driven by strength in its insurance business. Additionally, the company witnessed strong equity gains in the technology sector, particularly in Apple (AAPL) stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Berkshire Hathaway is a multinational conglomerate that owns subsidiaries involved in businesses such as insurance, freight rail transportation, utility and energy generation, and distribution.

Q4 Earnings Snapshot

Berkshire reported net earnings of $37.6 billion in Q4 2023, up 107.8% from the previous year. Additionally, operating earnings (net earnings excluding investment and derivative gains/losses and impairments of goodwill and intangible assets) increased 28% to $8.48 billion in the quarter.

Income from Insurance-underwriting increased 430% year-over-year to $848 million from $160 million. Also, Insurance-investment income rose 38% to $2.76 billion. However, earnings in Railroad, and Utilities and Energy, declined 7.8% and 14.5%, respectively.

Furthermore, investment and derivative gains (77% of the company’s earnings) jumped by about 154% year-over-year. This metric measures unrealized gains or losses arising from the change in market prices of the company’s investments in equity securities.

At the same time, the company’s cash balance was $167.6 billion as of December 31, 2023, up roughly $10 billion from the third quarter.

Is BRK.B a Good Stock to Buy?

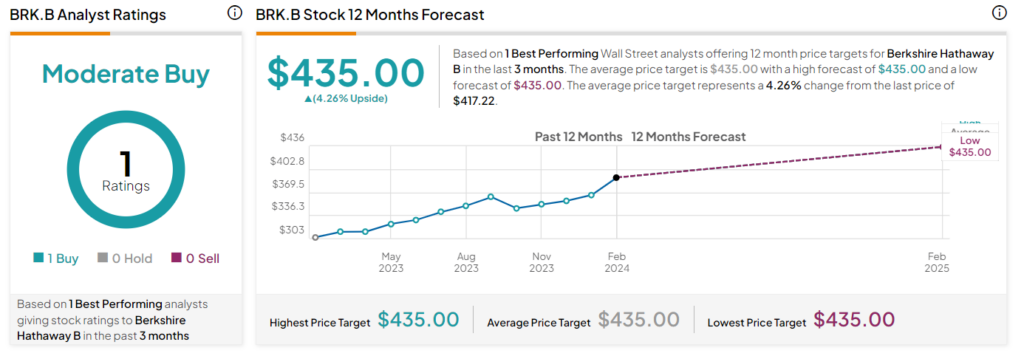

With one Buy recommendation, BRK.B stock has a Moderate Buy consensus rating on TipRanks. The average Berkshire Hathaway B price target of $435 implies a 4.3% upside potential from current levels. BRK.B stock has gained 37% over the past year.