The United Kingdom’s (U.K.) cryptocurrency industry has a little more than a year to prepare for a stricter regulatory environment under Britain’s finance regulator.

Matthew Long, director of digital assets at the U.K.’s Financial Conduct Authority (FCA), says the regulator intends to implement a new authorization regime for crypto companies starting in 2026. Essentially, this means that crypto firms in the U.K. will need to comply with a strict set of rules and legislation to receive and maintain an operating license in Britain.

Crypto firms such as Coinbase Global (COIN) and Gemini that enable trading in Bitcoin (BTC) and other digital assets will need to comply with anti-money laundering rules and other regulations to operate within the U.K. The FCA also intends to release papers on stablecoins, trading platforms, and staking in the lead-up to the new rules coming into effect.

Regulated Activities

Upcoming government legislation will also define what counts as a “regulated activity” pertaining to securities, and crypto firms will be expected to comply. Regulated activities are believed to include crypto and stablecoins, as well as payment, exchange, and lending activities.

Director Long stressed that the U.K. regulator is still determining the exact process crypto companies will need to go through to get authorization. The FCA is looking to Europe, which has already launched legislation for the crypto sector that includes tough compliance rules.

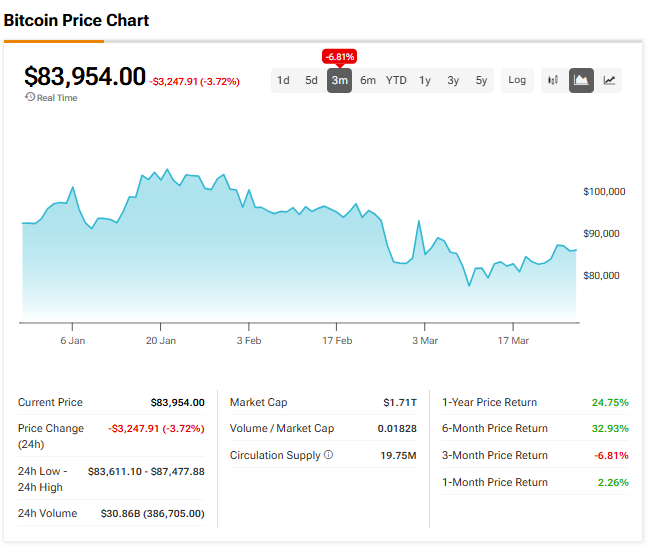

The price of Bitcoin, the biggest crypto by market capitalization, is currently trading at just under $84,000.

Is BTC a Buy?

Most Wall Street firms don’t offer ratings or price targets on Bitcoin, so we’ll look at the cryptocurrency’s three-month performance instead. As one can see in the chart below, the price of BTC has declined 6.81% in the last 12 weeks.