Bristol-Myers Squibb (NYSE:BMY) shares jumped nearly 2% in the early session today after the biopharmaceutical major posted an impressive performance for the fourth quarter. With a marginal year-over-year gain of 0.6%, revenue of $11.48 billion exceeded expectations by $290 million. Further, EPS of $1.70 came in better than estimates by $0.15.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Lower Revlimid sales were offset by gains from Eliquis and Opdivo, as well as the performance of new products. During the quarter, Eliquis sales increased by 7% to $2.87 billion, and Opdivo sales increased by 8% to $1.41 billion. Moreover, higher sales of Reblozyl, Opdualag, and Zeposia led to a 66% jump in the company’s new product portfolio revenue.

Looking ahead to Fiscal Year 2024, BMY foresees EPS in the range of $7.10 to $7.40. In addition, revenue growth for the year is anticipated in the low single digits.

Is Bristol-Myers Squibb a Good Stock to Buy?

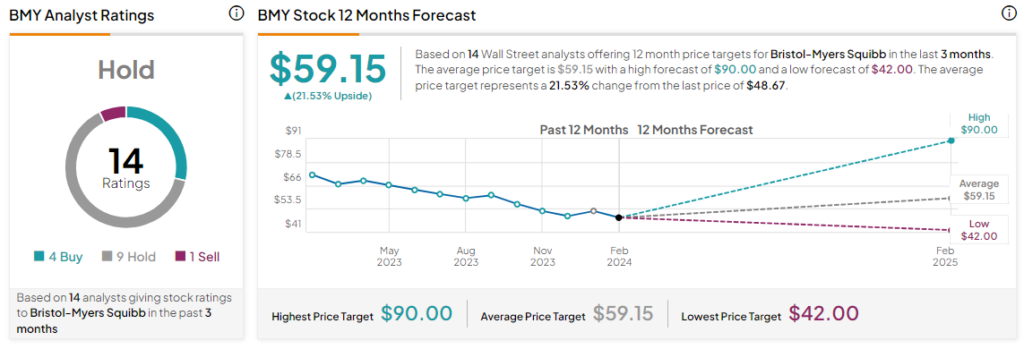

Overall, the Street has a Hold consensus rating on Bristol-Myers Squibb, and the average BMY price target of $59.15 implies a 21.5% potential upside in the stock. That’s after a nearly 31% drop in the company’s share price over the past year.

Read full Disclosure