This time of year is pretty much tailor-made for sitting indoors and hiding from weather. And that makes it a good time to watch television, in all its many formats. But for those in Canada who subscribe to entertainment giant Warner Bros. Discovery (WBD) and its Discovery+ system, bad news: you have one less option coming soon. The news had a limited impact, but still sent shares down fractionally in the closing minutes of Tuesday’s trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Some might think that Warner would back off of any major moves until the acquisition drama died down. But Warner still needs to operate, and so, it continues to make decisions. And one of its latest focuses on its streaming. When February 17 arrives, Discovery+ will halt operations in Canada, and in its place, a new version will rise run by Rogers Sports & Media (RCI).

While Canadians will not lose Discovery content, they will have to shuffle their subscriptions around accordingly. This has proven to be streaming’s Achilles heel; while originally, streaming was supposed to be a one-stop shop for all the content you could want, it is currently a fragmented landscape of ultra-competition and, somehow, surging prices.

Gunn Speaks

Meanwhile, writer / director James Gunn recently came out with a bit of commentary about what the sale of Warner is likely to mean, particularly if Netflix (NFLX) actually comes out on top. But Gunn was also being as politic as possible about the deal, and expressed as much recently.

Gunn said, “Do I have hopes? No, I really don’t because everything’s unknown. I think it’s all really exciting, frankly. So I hope and pray for the best.” Gunn also noted, “And I’ve been through these sorts of changes so many times that I’ll always be careful what you wish for because you don’t really know until you know.” With so much coming out for the DC Universe as a whole, a lot is riding on the upcoming deal, and any mid-stream changes could mean disaster.

Is WBD Stock a Good Buy?

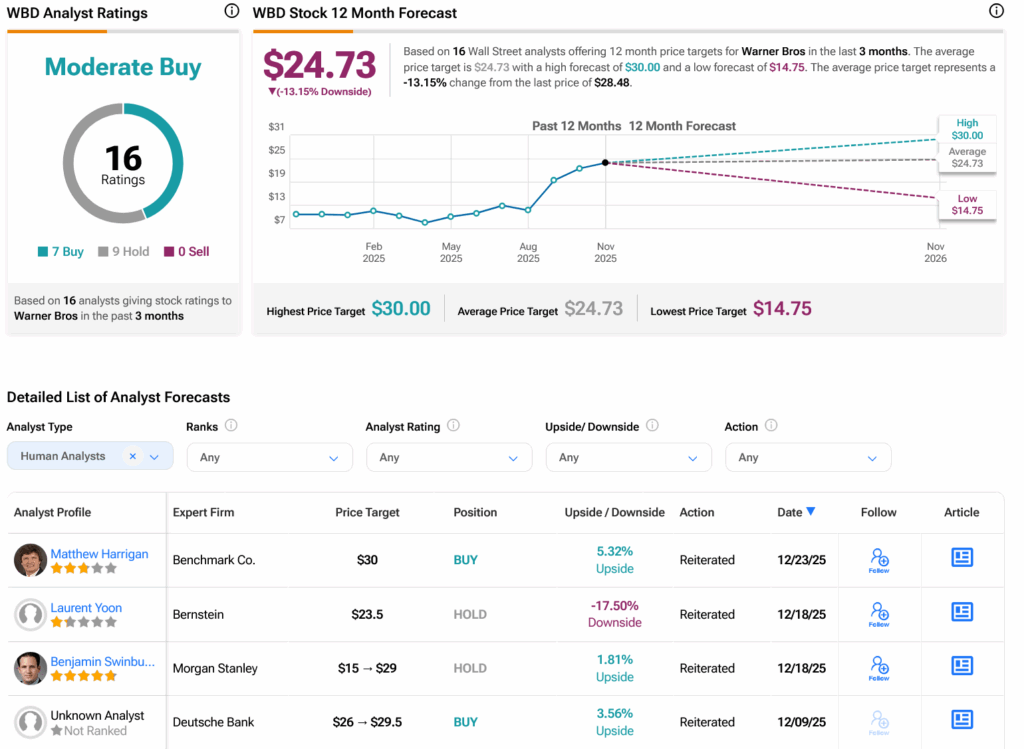

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on seven Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 171.46% rally in its share price over the past year, the average WBD price target of $24.73 per share implies 13.15% downside risk.