Shares of B&Q owner Kingfisher PLC (GB:KGF) fell sharply after the company lowered its profit forecast for Fiscal Year 2024/25 due to weak Q3 performance. The company revised its annual profit before tax (PBT) forecast range to £510 million to £540 million, down from the earlier estimate of around £510 million to £550 million. Following the update, Kingfisher shares dropped almost 15% on Monday.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Kingfisher PLC is a home improvement retailer, operating well-known brands like B&Q, Castorama, Screwfix, and TradePoint.

Budget Woes Weigh on Kingfisher’s Q3 Results

In Q3, Kingfisher sales declined by 0.6% on a reported basis and 1.1% on a like-for-like basis, reaching £3.22 billion. The top line fell short of analysts’ forecast of a 0.2% decline.

The company blamed the decline on budgetary measures in the UK and France. It mentioned an additional hit of £31 million in costs next year due to Labour Chancellor Rachel Reeves’ Autumn Budget in the UK. Additionally, France’s proposed social tax changes are expected to add £14m to costs in the next financial year.

Overall, businesses in the UK have raised widespread concerns about the financial impact of the Autumn Budget presented last month.

Jefferies Sticks to Hold Rating for KGF Stock

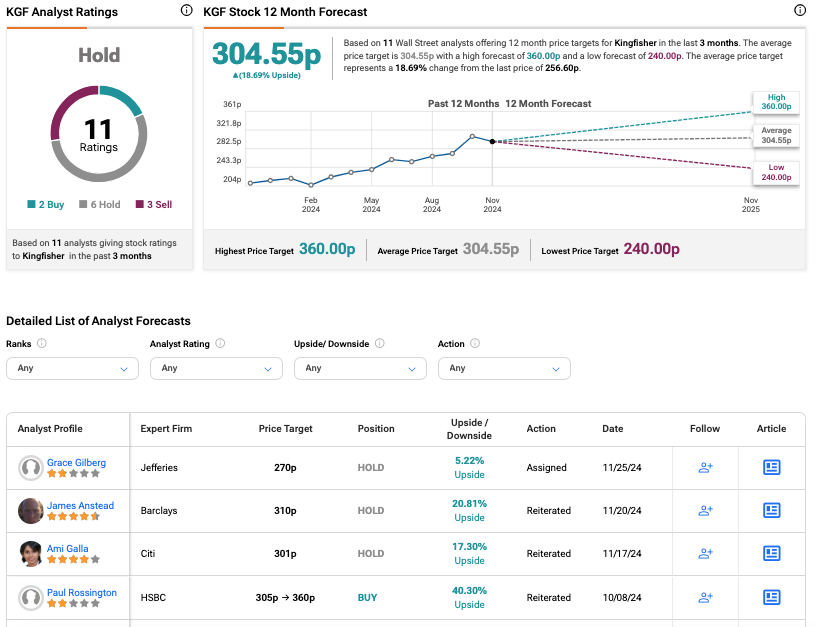

Following the results, Jefferies analyst Grace Gilberg reiterated a Hold rating on the stock, predicting an upside of 5.2%. Gilberg noted that the Hold rating reflects the company’s recent performance and outlook.

She pointed out that sales have underperformed in the UK and France, with early November trading indicating continued weakness compared to forecasts.

What Is the Share Price Target for Kingfisher?

Overall, on TipRanks, KGF stock has received a Hold rating based on 11 recommendations from analysts. It includes two Buy, six Hold, and three Sell ratings. The Kingfisher share price target is 304.55p, which is 18.7% above the current share price.