Shares of enterprise content platform provider Box (NYSE:BOX) tanked nearly 14% in the early session today after the company announced a mixed set of third-quarter numbers. Further, its financial outlook failed to impress investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue increased by 4.8% year-over-year to $262 million, landing in line with estimates. However, EPS of $0.36 missed the cut by $0.02. During the quarter, Billings decreased by 2% to $253.7 million.

On the other hand, the company’s gross profit increased to $192.3 million from $185.5 million in the year-ago period. Further, its remaining performance obligations increased by 7% to $1.12 billion.

Looking ahead to the fourth quarter, Box expects revenue to be in the range of $262 million to $264 million. EPS for the quarter is seen landing between $0.38 and $0.39. For Fiscal Year 2024, the company expects revenue to hover between $1.037 billion and $1.039 billion. EPS for the year is anticipated to be between $1.42 and $1.43. Previously, the company had projected EPS to be between $1.46 and $1.50 for the year.

Is Box Stock a Good Buy?

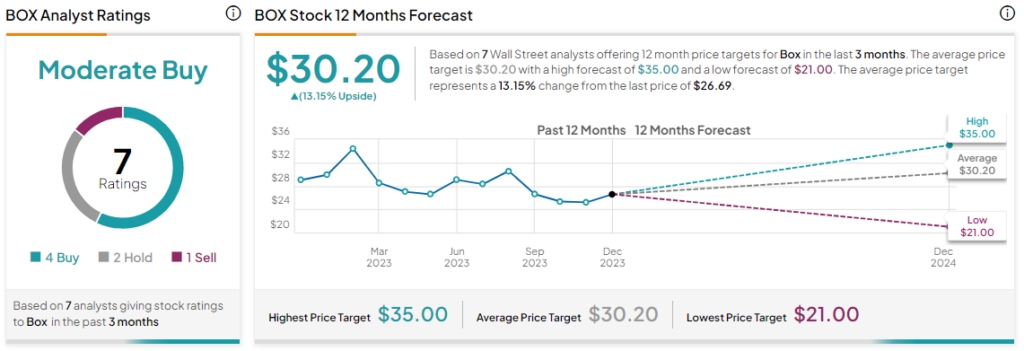

Today’s price decline comes on top of a 7% drop in the company’s share price over the past six months. Overall, the Street has a Moderate Buy consensus rating on Box, and the average BOX price target of $30.20 implies a modest 13.2% potential upside in the stock.

Read full Disclosure