File this one under “first world problems,” but for Canadian aircraft maker Bombardier (TSE:BBD.B) it will likely be a problem nonetheless. New reports have emerged about the state of the private jet market, and things are not looking bright therein. Investors, however, shrugged the news off, and sent Bombardier shares up fractionally in Friday morning’s trading.

This is something of a universal phenomenon, interestingly; consumer confidence is in open decline all over, and that is sending commercial air demand slumping in response. This attitude is even hitting the private jet market, as former private jet enthusiasts decide to take a wait-and-see approach to their next purchase, according to a Barclays’ study of business jet dealers and finance officials.

Business jet demand, the report noted, is down 49% just since March. Though this study only used data from 65 respondents, given the size of the business jet market in general, that is likely a good portion of the private jet sales market. The composite score, which also includes the 12-month outlook and pricing data, slid from 52 to 40, the single largest percentage drop since COVID-19 broke out.

Still Making Them Regardless

And in a move that proves that Bombardier is looking forward, reports note that the Global 8000 plans are proceeding as, well, planned. The new jet, which is supposed to be the fastest yet with speeds coming in right around the supersonic level—though current regulations forbid breaking the sound barrier—is still being constructed, even if demand for these is in the horse latitudes right now.

The Global 8000 is still on track to be perhaps the highest of high-end jets, and deliver impressive comfort, speed and capability. Though demand may be soft, that may not be the case forever—it generally is not—and when demand comes back, Bombardier will be ready with a top-notch jet that meets a lot of needs all at once.

Is Bombardier Stock a Good Buy?

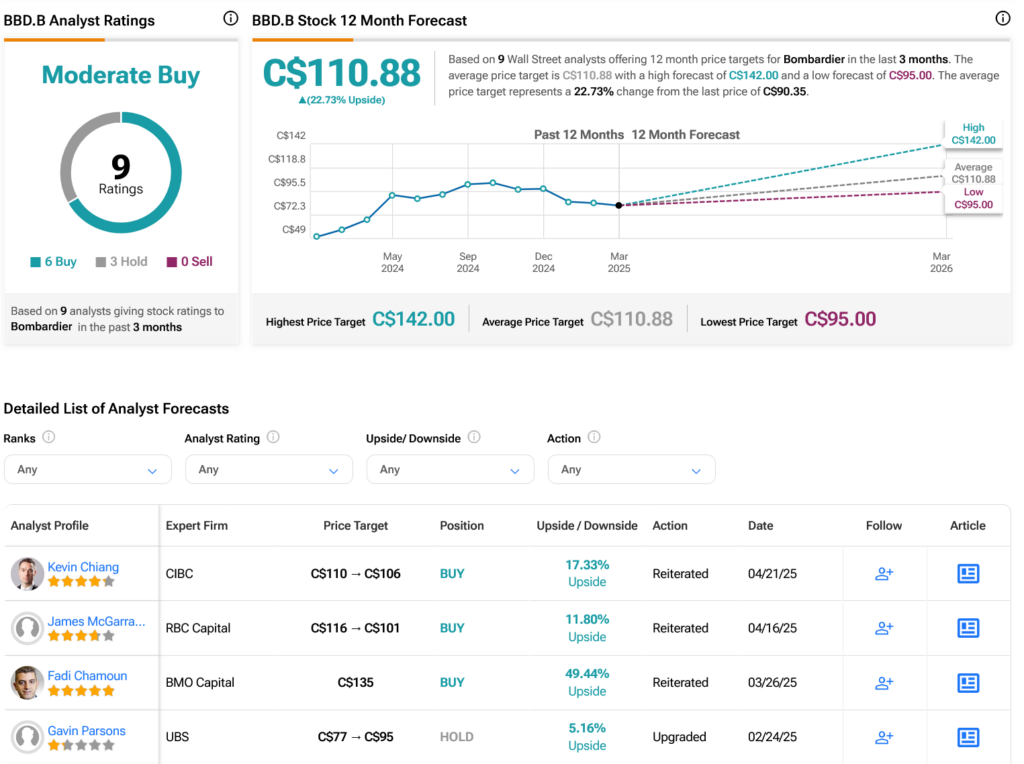

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:BBD.B stock based on six Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 41.62% rally in its share price over the past year, the average BBD.B price target of C$110.88 per share implies 22.73% upside potential.