“Nvidia has been the driver, the one stock that really set the tone,” said Kim Forrest, chief investment officer at Bokeh Capital Partners, in a note to Yahoo Finance. That’s not hyperbole. It’s a reflection of how tightly Wall Street’s hopes for AI are now linked to one name: Nvidia (NVDA).

Big Tech Spending Fuels Nvidia Rally

Microsoft (MSFT) just pledged $80 billion to AI infrastructure. Meta (META) is now forecasting capital expenditures between $64 billion and $72 billion. Both announcements came within days of each other and sent Nvidia stock jumping 4.5% in premarket trading.

That’s no accident. Nvidia’s chips are the backbone of this AI buildout. Their next-gen Blackwell architecture is expected to drive the next motion of model training. And investors know it.

Fund Managers Stick with Nvidia Despite Valuation Fears

Michael Sansoterra, CIO at Silvant Capital Management, told MarketWatch that Nvidia still leads the AI pack and will benefit from its deep technology edge, even with rising tensions around U.S.–China tariffs. His fund holds Nvidia and sees upside from its Blackwell chips despite competition from Chinese rivals like Huawei.

Kim Forrest echoed that view. She called Nvidia the “tone setter” for AI demand across the market. That kind of conviction doesn’t come lightly from institutional voices.

Huawei Competition Looms but Demand Stays Strong

Not everything is rosy. Nvidia recently dipped 2.1% on news that Huawei’s new Ascend 910D chip could outperform its H100 GPU. The race for AI dominance is global. And the U.S. export ban on advanced chips to China still weighs on sentiment.

But for now, demand keeps climbing. Investors are eager to analyse Nvidia’s upcoming earnings. And with Big Tech now writing massive checks for AI, the question isn’t whether Nvidia can sell chips. It’s how fast they can ship them.

Is NVIDIA a Buy, Hold, or Sell?

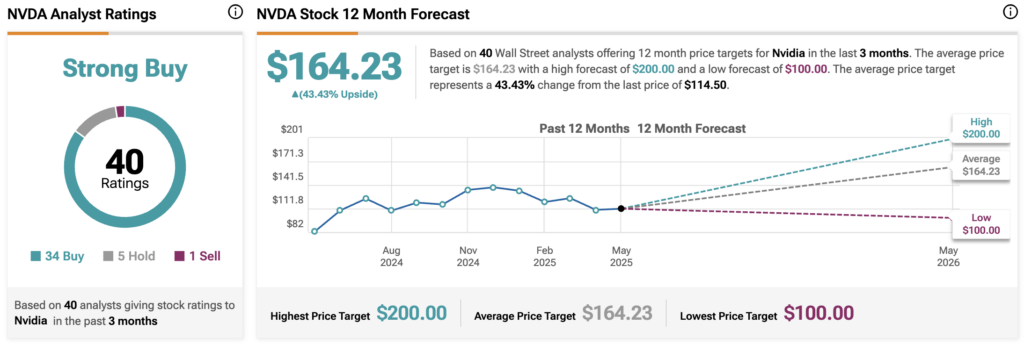

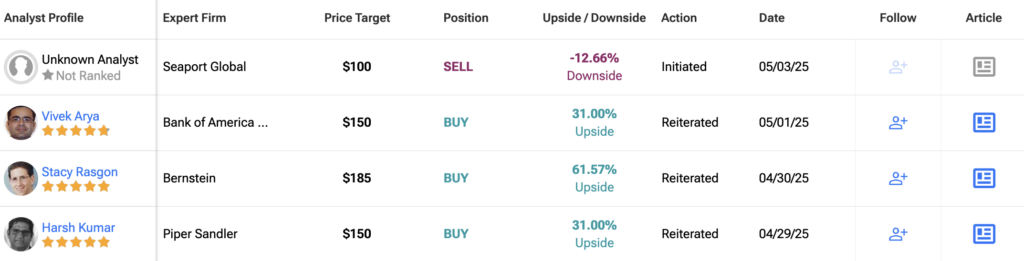

Wall Street’s love affair with Nvidia isn’t cooling anytime soon. According to TipRanks, the stock is rated a Strong Buyby 40 analysts, with a whopping 34 recommending it as a Buy, five on Hold, and just one calling for a Sell.

The average 12-month NVDA price target sits at $164.23, implying a 43.43% upside from its current trading price of $114.50. Bullish analysts see Nvidia hitting as high as $200, while the most cautious set a floor at $100.

That optimism lines up with the broader story. As detailed in the full article, fund managers are piling in. AI chip demand keeps soaring. And with Big Tech backing up the truck on AI infrastructure, analysts are betting Nvidia can stay ahead of the pack.