Bank of America (BAC) shared new data for October 2025 that examines how U.S. fund managers are investing in semiconductor and electronic design automation stocks found in the S&P 500 (SPY). More precisely, it measured both “breadth” (the number of fund managers that own a stock) and “depth” (the percentage of the stock held in their portfolios compared to its weight in the S&P 500). This provides a clear picture of how actively managers are investing in specific tech companies. According to analysts led by five-star Vivek Arya, Nvidia (NVDA) continues to have the broadest ownership.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In fact, 76% of fund managers hold the stock, which is up 219 basis points from the previous quarter and 539 bps year-over-year. Still, the stock’s portfolio weight is only slightly above that of its peers, at 1.11x compared to a 1.06x median. In contrast, Advanced Micro Devices (AMD) is still underweight, as it’s held by just 24% of fund managers. That’s up from 20% in July but down sharply from 38% in October 2024. AMD’s relative weighting also rose slightly to 0.19x, but it is still far below last year’s 0.59x. Nevertheless, BofA kept its Buy rating and $300 price target on AMD.

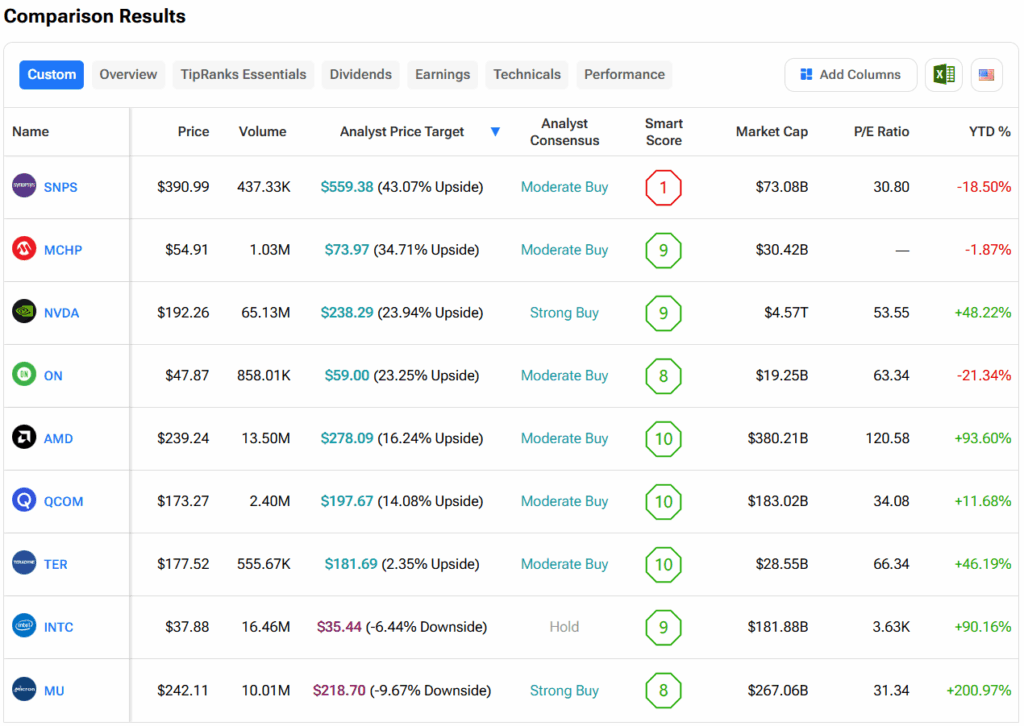

In addition, the biggest gains in fund ownership this quarter were seen in Synopsys (SNPS), which added 466 bps after its $35B Ansys deal closed in July. On the other hand, Qualcomm (QCOM), ON Semiconductor (ON), and Microchip Technology (MCHP) saw the largest drops in ownership. In terms of portfolio depth, AMD, Teradyne (TER), and Intel (INTC) saw the biggest increases, while ON, Micron (MU), and Qualcomm declined. Overall, semiconductor weighting in portfolios sits at 0.96x, which is slightly lower than December 2024 but a bit higher than August 2025.

Which Semi Stock Is the Better Buy?

Overall, out of the stocks mentioned above, analysts think that SNPS stock has the most room to run. In fact, SNPS’ average price target of $559.38 per share implies more than 43% upside potential. On the other hand, analysts expect the least from MU stock, as its average price target of $218.70 equates to a loss of 9.7%.