Financial services giant Bank of America (BAC) is optimistic about AI spending and has named Nvidia (NVDA), Broadcom (AVGO), and Advanced Micro Devices (AMD) as its top picks in the semiconductor sector. Indeed, the firm, led by five-star analyst Vivek Arya, said it remains confident in AI-related chip, memory, and semiconductor equipment stocks, even though short-term volatility is expected. Bank of America also noted that this week’s Consumer Electronics Show conference could highlight new growth opportunities in areas like robotics and on-device AI.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Interestingly, the firm estimates that around $600 billion in capital spending will occur this year, which will keep AI as the main driver of investment. However, investors are increasingly focused on how efficiently that money is being used, rather than just headline spending levels. Nevertheless, Bank of America said that strong free cash flow at major hyperscalers such as Amazon (AMZN), Google (GOOGL), and Microsoft (MSFT) should help reduce some concerns.

Among semiconductors, Bank of America believes that Nvidia stands out as the best positioned. The firm pointed to Nvidia’s strategy of targeting the entire AI stack, which has been supported by recent licensing deals and acquisitions. It also highlighted Nvidia’s strong supply-chain coordination as an advantage in a constrained wafer and memory environment. Looking ahead, Bank of America expects next-generation AI models to further strengthen Nvidia’s position relative to alternative chip platforms.

What Is a Good Price for NVDA?

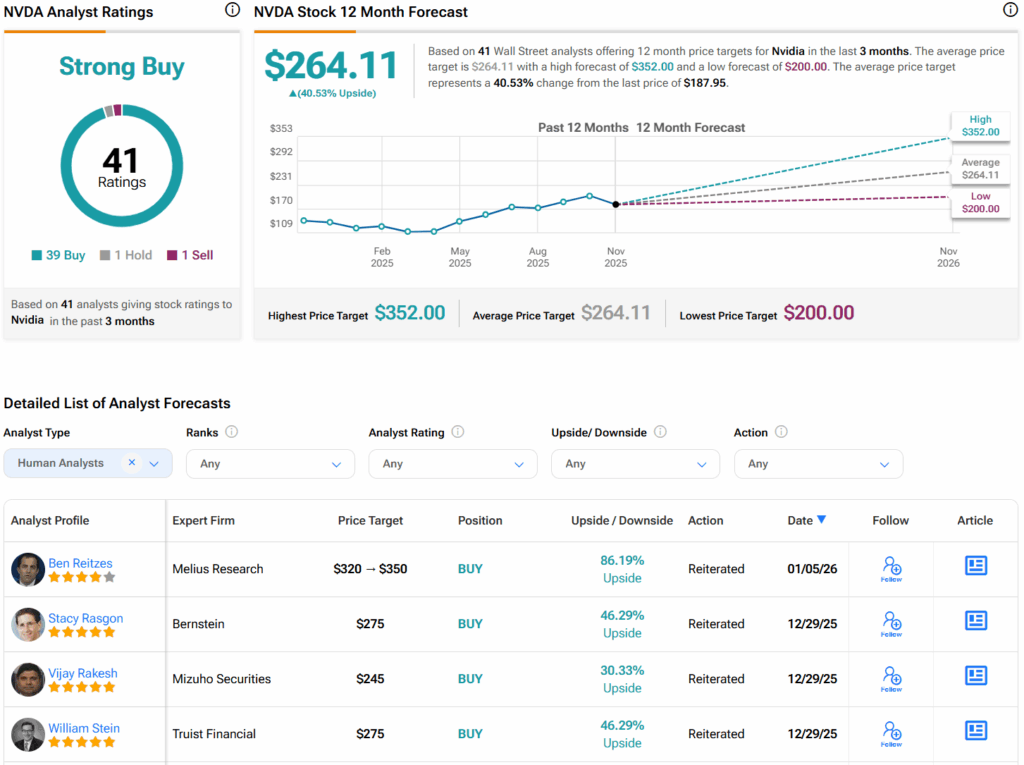

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $264.11 per share implies 40.5% upside potential.