One of the big things for aerospace stock Boeing (BA) was the fundamental revamping of its culture. This was, apparently, a necessary step in getting the Federal Aviation Administration’s (FAA) production cap removed. Now, details have emerged on one major part of that change. But investors do not seem pleased about this, and shares slipped nearly 2% in Wednesday afternoon’s trading.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Dating back to 2019, Boeing has had in place what it calls the “Speak Up” system, which is designed to be used by employees to report “concerns.” Boeing employees, meanwhile, seemed to regard the Speak Up system as more like an employee trap, in which employees would blithely wander and then, at best, be ignored. At worst, they feared drawing the wrath of supervisors, which is exactly the opposite condition you want when it comes to reporting potential safety hazards.

So now, the Speak Up system will instead be routed through “a third party” at the company, thus putting a layer of insulation between the employee who complained and the people who could fire said employee for completely unrelated reasons, of course. The move is actually proving helpful; reports filed via Speak Up, reports note, better than tripled between 2023 and 2024. Boeing also noted that it modified an inspection program for the FAA, where some inspection tasks are handed off to Boeing employees instead of FAA personnel. Previously, those employees reported to their program heads. Now, the reports go to an “engineering leader with expertise in jet certification and safety.”

Not Concerned About Delays

Remember when we found out about Etihad Airways’ planned order of several Boeing jets? Remember when we immediately posited that Etihad would not see those jets any time soon because of the sheer size of Boeing’s backlog? As it turns out, that will not be a problem, noted a CNBC report.

First, Etihad is working on what it calls a “diligent” approach to fleet planning, which allows it to better withstand such setbacks. Second, Etihad also looks for things to improve at Boeing, which they have been for the last few months, though not perhaps to the degree airlines would like to see. And, given that Etihad deliberately ordered some planes that it knew would not be available for a while—like the 777X, which is still undergoing certification processes—its fleet planning schedule basically expects delay from Boeing as part of the course.

Is Boeing a Good Stock to Buy Right Now?

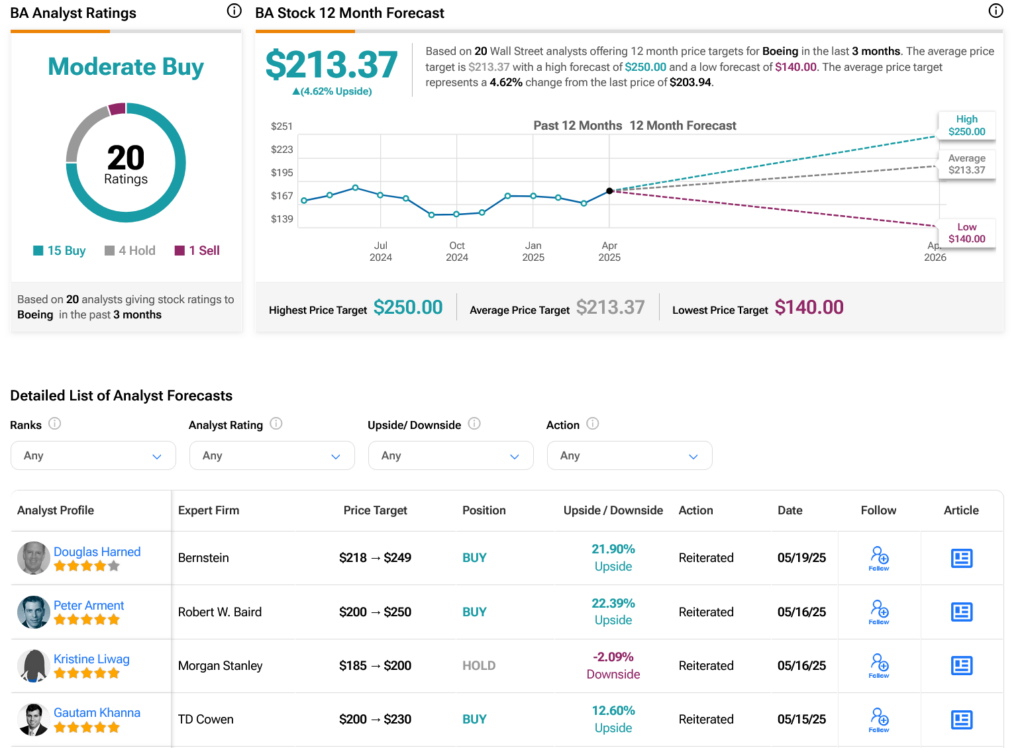

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, four Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 11.48% rally in its share price over the past year, the average BA price target of $213.37 per share implies 4.62% upside potential.