For a while there, whenever President Trump went visiting a country to set up trade deals, aerospace stock Boeing (BA) got direct benefit as countries bought Boeing aircraft to help reduce trade deficits. This even happened in China. But new reports suggest that good feeling only went so far, as China took aim at 20 different companies, and 10 specific executives, and Boeing was one of them. This meant little to investors, though, who sent Boeing shares up fractionally in Monday afternoon’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

China announced the penalties after the United States revealed plans to sell a whopping $11 billion in weapons to Taiwan, which China does not acknowledge as a country. But China was also judicious about its own sanctions, specifically targeting Boeing’s military arm as opposed to its commercial airline operation.

The move is mostly symbolic, reports note, and includes asset freezes, a ban from Chinese transaction operations, and a direct ban on entering the Chinese mainland for the executives in question. Since these firms have few assets in the country and seldom do much actual trade there, the freezes and bans should mean little overall.

Another Production Bump

Boeing managed to get its production up on 737 MAX jets in 2025, and there are signs it looks for another upgrade in 2026. Boeing plans to get the jet count up to 47 per month sometime next year, which is actually a modest increase from the 42 a month it is making right now.

Reports note that Boeing looks to boost that figure by early summer, which might be a bit of a stretch. The number is not so much of a change, though; originally, Boeing got approval to go from 38 to its current 42. From 42 to 47 is a similarly-sized interval.

Is Boeing a Good Stock to Buy Right Now?

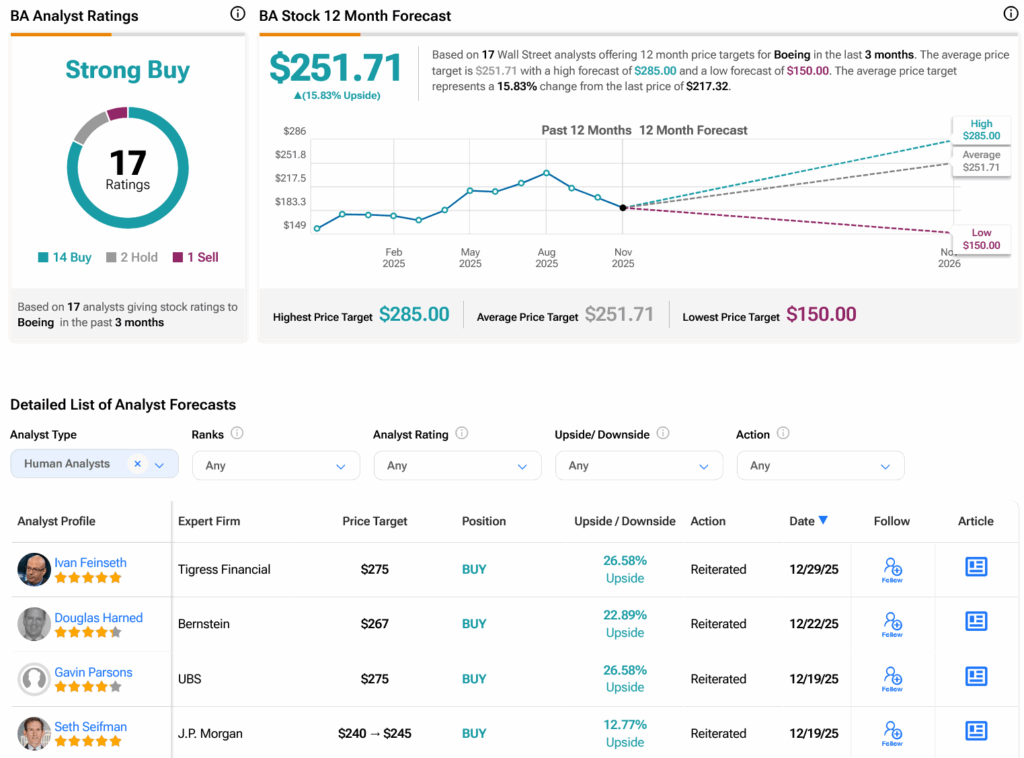

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 14 Buys, two Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 22.59% rally in its share price over the past year, the average BA price target of $251.71 per share implies 15.83% upside potential.