Good news for aerospace stock Boeing (BA) emerged as the Air India crash just became a lot less like Boeing’s fault. The fuel control switches recently passed safety checks with the Federal Aviation Administration (FAA), removing a major potential cause of the crash. That was good enough for investors, who gave Boeing shares a modest boost in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The fuel safety switches became a major part of the analysis of the Air India crash, especially after a preliminary report released from investigators noted that fuel to the Dreamliner’s engines had been cut just moments after takeoff. This provided an excellent explanation for why the aircraft’s Ram Air Turbine (RAT) system deployed, but became a question in and of itself.

Reports from India’s Aircraft Accident Investigation Branch (AAIB) note that the fuel cutoff switches had been moved from “run” to “cut-off.” Doing that accidentally is virtually impossible as the switches are specifically designed to protect against such accidents. The AAIB also noted a 2018 FAA advisory that urged airlines to check that locking feature to ensure the protection they provided was actually working. Air India did not take that advice to heart, reports noted.

One Step Closer for the 777X

Better yet, the 777X line is also getting closer to seeing service. While there are still several months between now and the official launch, some recent retooling work has brought Boeing one step closer. The 777X line is now on track to be certified this year. And with EIS approval next year, the 777X may finally start going into production and seeing wide use.

The 777X line has already come a long way, with the GE9X engines requiring removal and return for an outright redesign due to “technical issues.” Moreover, the software needed to be revamped as it was calling for “…uncommanded nose-down flight anomalies.” A full review of work on the 777X following the 2018 and 2019 737 Max crashes, and even the rise of COVID-19 itself, prompted further delays that are only now being fully addressed. But all this has been addressed, and now, the 777X is closer than ever to release.

Is Boeing a Good Stock to Buy Right Now?

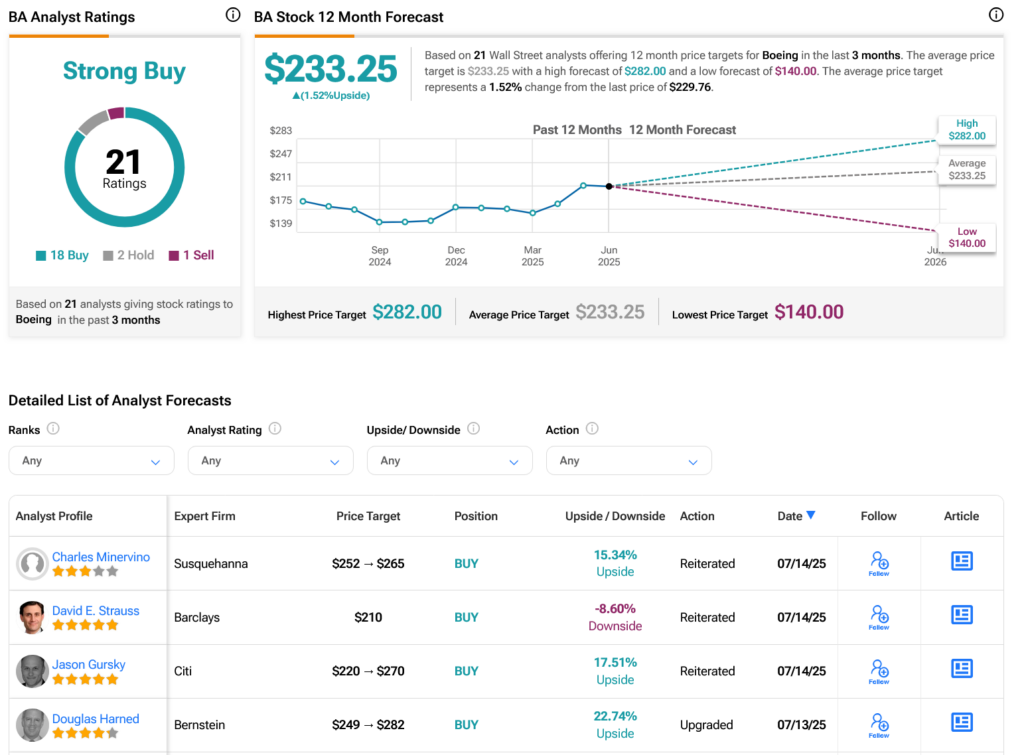

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 18 Buys, three Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 26.65% rally in its share price over the past year, the average BA price target of $233.25 per share implies 1.52% upside potential.