There is good news and bad news at aerospace stock Boeing (BA) right now. Its production processes are starting to make a comeback, looking to reach their caps and, hopefully, do so in a manner sufficiently safe that the government can take the caps off, eventually. But there are some problems lurking in the background as well, and this combination is leaving investors concerned. Boeing shares were down fractionally in Tuesday afternoon’s trading.

Boeing’s 2025, so far, is going much better than its 2024 did. This time last year, Boeing was just starting to deal with the fallout from the door plug incident. Now, it is moving along, addressing points raised by regulators, and getting on with business. Its labor relations are, mostly, settled, a contract is in place, new safety measures are up and running, and things are generally looking up.

Indeed, Brian West—chief financial officer and executive vice president of finance with Boeing—noted that 2025 could “…look like 2023, maybe a bit better if things go our way,” a point that could not help but resonate. But Boeing does have some serious issues to address, not least of which is tariffs. With tariff concerns weighing on nearly every supply chain out there, businesses are scrambling to find alternatives that are up to snuff. Boeing’s own culture is also likely to prove troublesome, and resilient; that kind of change hardly happens overnight.

A Fighter Jet Win

Boeing then got a win from the United States Air Force, as its new F-15EX fighter jet, part of the Lot 2 release, concluded a successful test flight. The F-15EX is a refined version of the F-15, reports noted, and its successful test flight suggests that Boeing can still be a major part of the United States military. That alone could keep Boeing in business for a long time to come.

Given that the F-15EX’s predecessors, the F-15C/D line, have been in service since the 1980s, it was clear that a replacement would likely have to be forthcoming. But with the F-15EX behaving as well as it has so far, that replacement may be able to step in in short order, providing a surprisingly smooth—especially for anything with the Boeing label on it—transition.

Is Boeing a Good Stock to Buy Right Now?

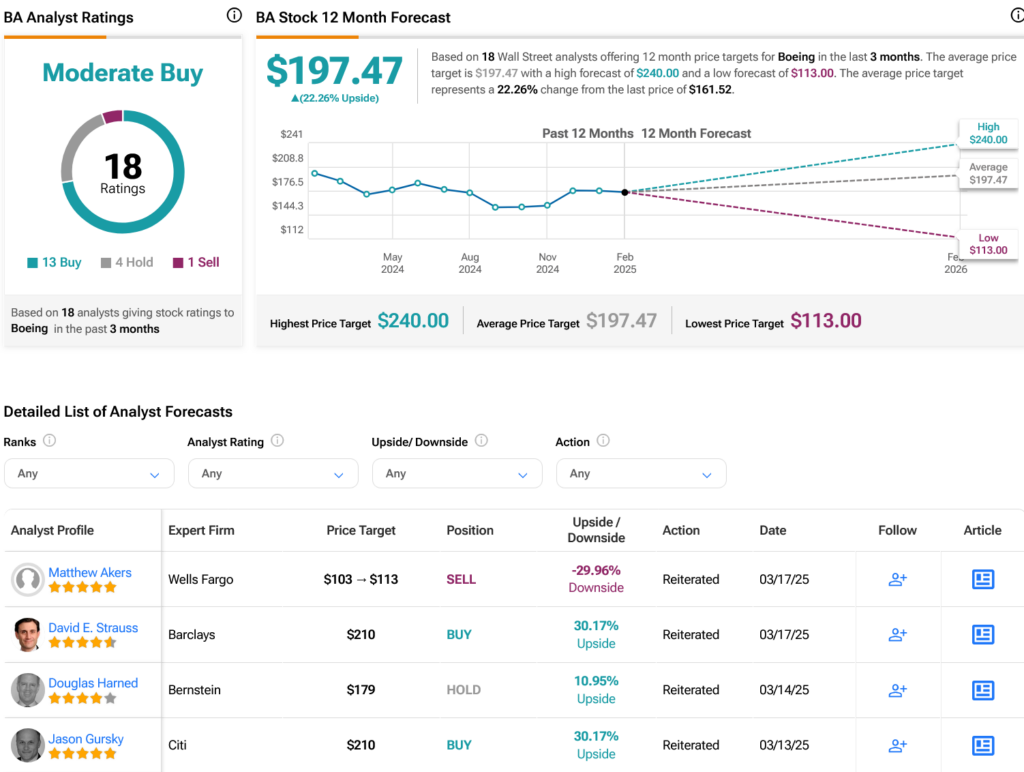

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 13 Buys, four Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 10.94% loss in its share price over the past year, the average BA price target of $197.47 per share implies 22.26% upside potential.

Questions or Comments about the article? Write to editor@tipranks.com