When you have a client as big as the United States government, it might be a good idea to be accommodating. Particularly when that government is headed by a force like Donald Trump. But aerospace stock Boeing (BA) is a bit less concerned about its appearance on this front, and thus, is delaying the rollout of Air Force One until 2029. Investors took the news modestly well, and Boeing shares gained fractionally in Tuesday afternoon’s trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

You might remember that, back in the first Trump administration, President Trump put in an order for two Boeing 747-8 aircraft to serve as Air Force One. Boeing got that order back in 2018, and when Trump first left the White House in late 2020, the order had not been filled. Four years and a Biden administration later, the order has still not been filled.

And now, we have recently heard that the order will still not be filled, 10 years after it was originally placed. The new 747-8 aircraft will not be delivered until 2029, or possibly later. There was once hope that the second Trump administration could see the plane’s arrival, with an original expected date of 2027 or 2028, but that hope is gone, and it is now 2029 or later.

Still Totally Not Stranded

Boeing’s astronauts, Butch Wilmore and Suni Williams, are still stuck on the International Space Station (ISS), though plans are in the works to get them home in March, despite the fact they were supposed to be home in June of 2024. But the duo are eager to note—much like Boeing itself has noted several times previously—that they are totally, totally not stranded.

Instead, the duo note, we should address the matter by saying they are “committed” to the trip. Neither one of them feels “stuck” or “stranded,” so we should stop saying that they are, just because they cannot return until someone comes to get them. It is hard not to be reminded of Hamlet here, and note that the lady doth protest too much, methinks. And the guy is not too far behind in the rate of protest either, mealsothinks.

Is Boeing a Good Stock to Buy Right Now?

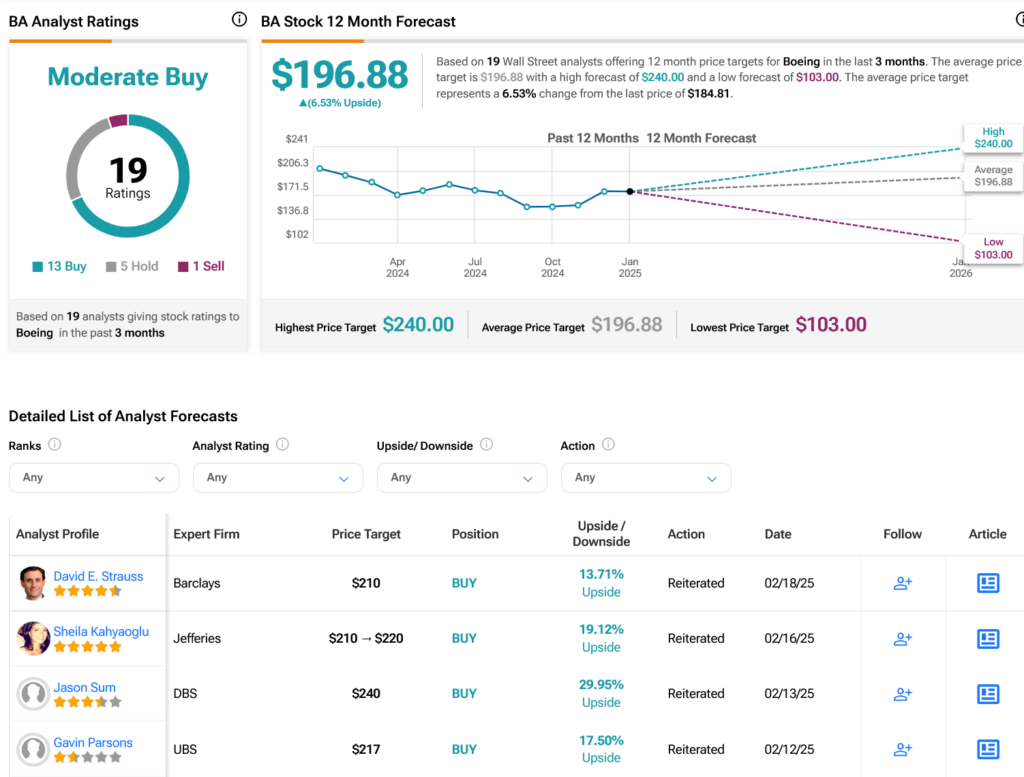

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 13 Buys, five Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 9.19% loss in its share price over the past year, the average BA price target of $196.88 per share implies 6.53% upside potential.