So last week, we heard that aerospace stock Boeing (BA) is starting to take it on the chin as a result of the strike in St. Louis. Delayed plans, reduced sales, and a growing concern about image in its military operations are starting to hurt. And the IAM is calling attention to this point, saying Boeing has “…backed itself into a corner.” Investors disagree, however, as they sent shares up around 2% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The union noted what Boeing has made clear from nearly the beginning: the “economic parameters” of its offer will remain unchanged. While a certain amount of this makes sense—realities are what realities are, and even a union can price itself out of the market—the union points out that this is, basically, “stubbornness.”

The union also spelled out exactly what its proposals would cost Boeing to carry out, a point which does a pretty effective job of scuttling any concerns about Boeing’s ability to pay. The union pointed out that the union’s latest proposal would cost Boeing an extra $8 million…over the course of four years. Boeing currently has a defense backlog of $76 billion, reports note. The union topped it off by declaring, “It’s clear that the company is simply doing this to try to break you—and to break your union.” Seeing Boeing’s response to this should be interesting.

Chunks for Sale

So even as Boeing tries to resolve the process holding up a $76 billion defense backlog, Boeing also moved to sell off some of its digital aviation solutions assets. It raised $10.5 billion in cash, and sold them off to Thoma Bravo, a software investment operation.

Boeing sold off AerData, ForeFlight, Jeppesen, and OzRunways, among others, seeking to not only raise cash but also focus on its core operations, reports noted. Boeing did not sell off all of its digital assets, reports note; it kept a few of them, specifically, those that dealt with aircraft operations and fleet operations that supported key functions like diagnostics and repair services.

Is Boeing a Good Stock to Buy Right Now?

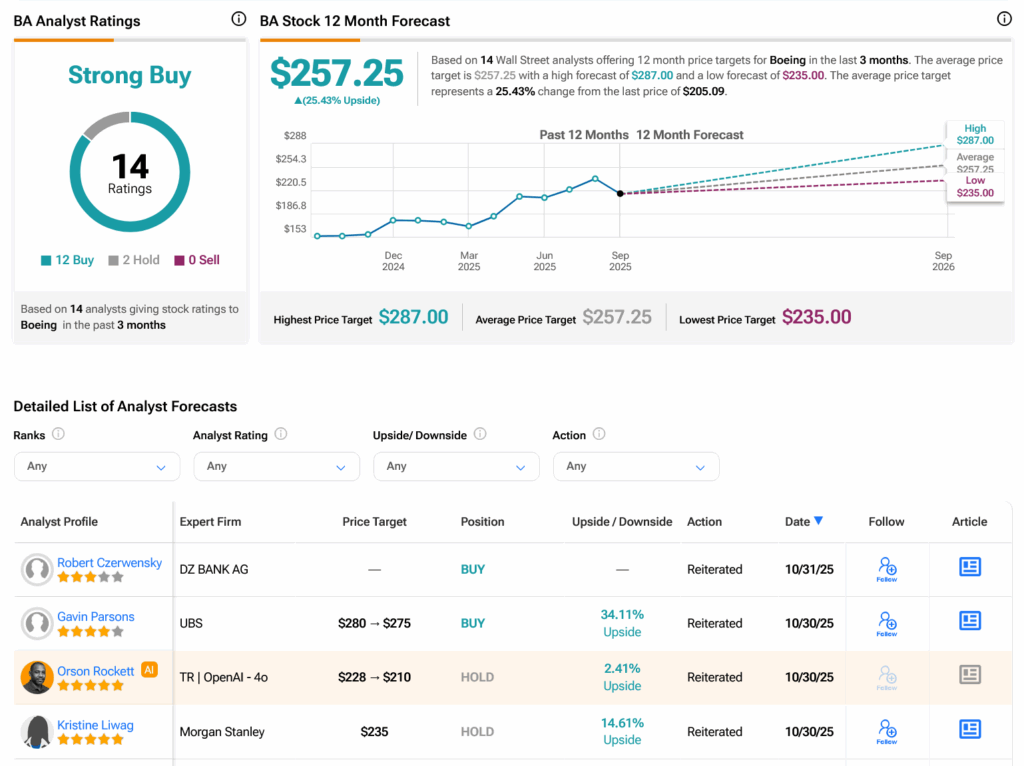

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 12 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 29.63% rally in its share price over the past year, the average BA price target of $257.25 per share implies 25.43% upside potential.