Seven independent board members at DNA-testing company 23andMe Holding Co. (ME) have resigned in protest over plans to take the company private.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The board members presented a joint resignation letter to company founder and CEO Anne Wojcicki saying they are leaving the company effective immediately. The move comes after a protracted battle over whether to take the struggling company private and delist it from the Nasdaq stock exchange. ME stock has declined 97% since the company went public in 2021 and currently trades at $0.34 per share.

23andMe’s Struggles

In their resignation letter, the board members wrote that they differ with Wojcicki on the “strategic direction for the company” and could not carry on at the company in good faith. The board members had wanted to sell 23andMe rather than take the company private. But CEO Wojcicki controls 49% of 23andMe votes and had blocked board members in their efforts to shop the company to potential buyers. Wojcicki is now the only remaining board member at the company.

In a memo to staff that has been made public, Wojcicki wrote that she was “surprised and disappointed” by the board members’ decision to resign, but added that taking 23andMe private is the best plan for the company and that she will rebuild the board of directors. 23andMe remains unprofitable and has warned that it could run out of cash in 2025.

Is 23andMe Stock a Buy or Sell?

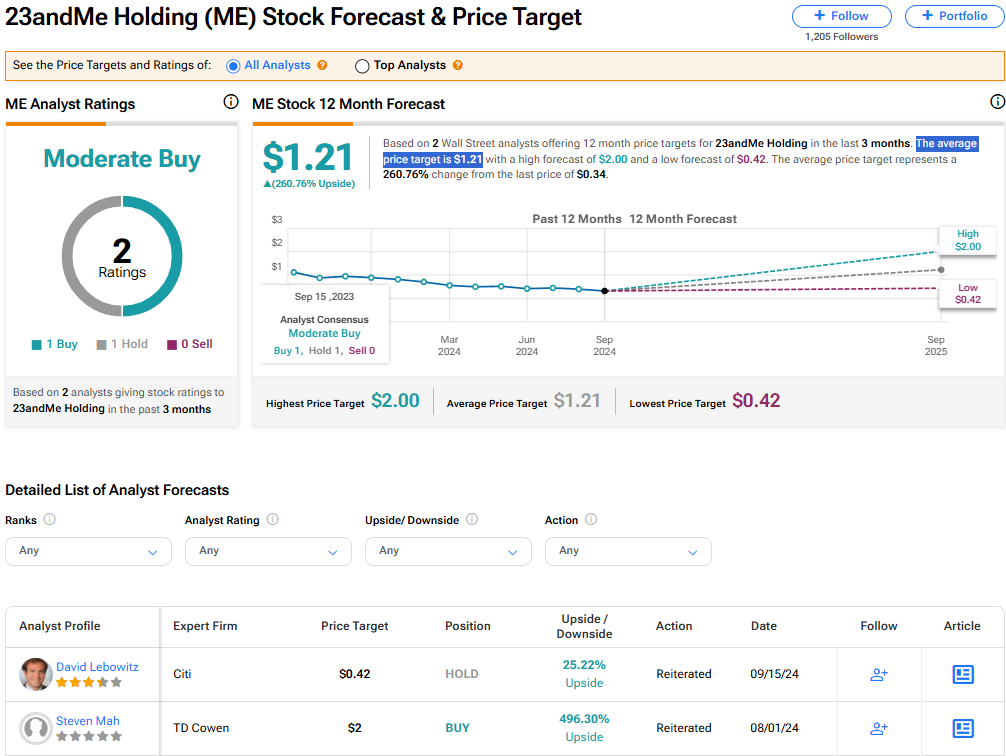

The stock of 23andMe has a consensus Moderate Buy rating based on the views of two Wall Street analysts. One analyst rates the stock a Buy and the other rates it a Hold. There are no Sell ratings currently. The average price target of $1.21 per share implies potential upside of 260.76% from where the shares currently trade.