During BMW’s annual investor conference, the green hydrogen sector received a positive jolt when the BMW CEO, Oliver Zipse, affirmed the company’s dedication to advancing the technology. BMW (FWB:BMW) has already deployed a fleet of hydrogen fuel cell cars worldwide for more than a year. The company plans to introduce three hydrogen vehicles at dealerships in the upcoming year. This announcement follows a period of subdued activity in the hydrogen automotive industry.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Moreover, the renewed interest from car buyers, investors, and tech enthusiasts shows that people are realizing different technologies will compete as we use less fossil fuels in the future.

Significance of Green Hydrogen

There are several reasons why BMW’s announcement is significant for the green hydrogen industry. Firstly, BMW’s endorsement signals growing interest and investment in green hydrogen. Secondly, green hydrogen production involves splitting water molecules using energy from non-carbon emitting sources, highlighting its environmental benefits. Finally, distinguishing green hydrogen from alternatives like blue and ‘dirty’ hydrogen emphasizes its superior environmental credentials and its role in achieving carbon neutrality.

Green Hydrogen Fuels the Future of Driving

As a prominent automaker, BMW’s commitment and investment in validating the potential of hydrogen technology could encourage other car manufacturers to follow suit. BMW’s CEO, Oliver Zipse, said that hydrogen fuel cells combine the best of both worlds. They include the ‘advantages of emission-free e-drive with fast refueling.’ He said the company views this additional technology as having a place in the future.”

The fleet of BMW cars and SUVs currently undergoing road tests demonstrates the increasing recognition of hydrogen’s unique advantages. This is especially true for long-range vehicles and heavy-duty transport, where battery technology still encounters limitations. Unlike battery electric vehicles (BEVs), Fuel Cell Electric Vehicles (FCEV) provide fast refueling times and extended range, as the fuel cell powers the motors instead of a lithium-ion battery. This is perceived as a desirable option for both consumers and commercial use.

Investment Opportunities in Green Hydrogen

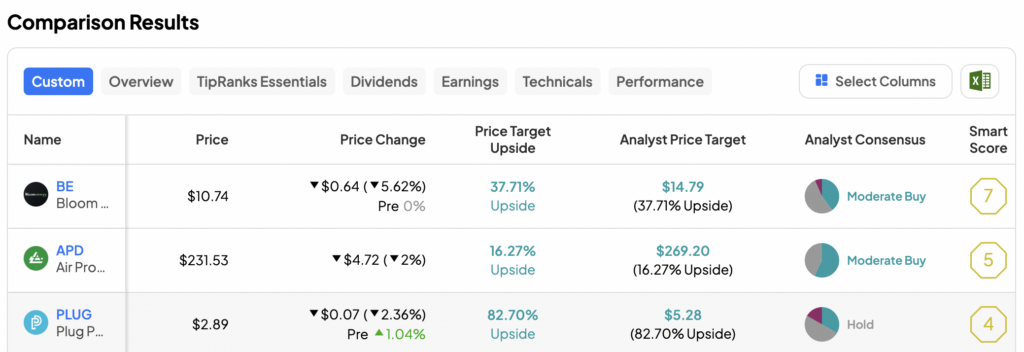

Investment opportunities vary significantly in the green hydrogen sector. Investors should examine company projections, business lines, and analyst ratings. Some companies, like Bloom Energy (NYSE:BE), are pure plays on hydrogen, offering potentially higher rewards but with greater risk due to less diversification. Air Products and Chemicals (NYSE:APD) is less of a pure play in the hydrogen sector, despite being the world’s largest hydrogen producer. This is because hydrogen production constitutes only a fraction of its total business. Others, such as Plug Power (NASDAQ:PLUG), faced severe cash flow issues earlier this year, which appear to have been resolved.

Using the TipRanks Stocks Comparison tool, we find that PLUG stock has the highest upside potential, at 82.70%, despite having a Hold consensus rating. Conversely, while BE and APD stocks display lower upside potential compared to their current prices to the average analyst price target, both are rated as a Moderate Buy.

Key Takeaway

Green hydrogen technology seems to be back on the road to broader adoption. BMW’s dedication to FCEVs could spur growth across the entire hydrogen sector. As innovation progresses and infrastructure expands, green hydrogen stands poised to become a significant player in shaping a sustainable future. This also opens up investment avenues for those seeking to benefit from the shift towards clean energy.