BMO Capital Markets (BMO) has reiterated its Buy-equivalent outperform rating on Eli Lilly (LLY) stock with a $900 price target on the shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analyst Evan Seigerman reaffirmed his strong outlook for LLY stock after the U.S. pharmaceutical giant announced its plans to acquire privately held SiteOne Therapeutics for $1 billion in a deal that will give Eli Lilly greater access to non-opioid pain medication.

Seigerman says the purchase of SiteOne is a smart strategic move on the part of Eli Lilly that will bolster its portfolio of pain management medications, positioning it to better compete with companies such as Vertex (VRTX). SiteOne’s leading pain drug is currently in a Phase 2 clinical trial.

Committed to Pain Management

“Lilly is expanding its presence in pain and looking to compete with the likes of Vertex with this announced deal to acquire privately held SiteOne therapeutics for as much as $1B,” wrote Seigerman in a note to clients about Eli Lilly.

BMO Capital Markets adds that the deal to buy SiteOne underscores Eli Lilly’s commitment to the pain treatment market, where it has long had a presence. By integrating SiteOne’s products into its own line-up, Eli Lilly should gain a competitive edge in the pain management space, said Seigerman.

Is LLY Stock a Buy?

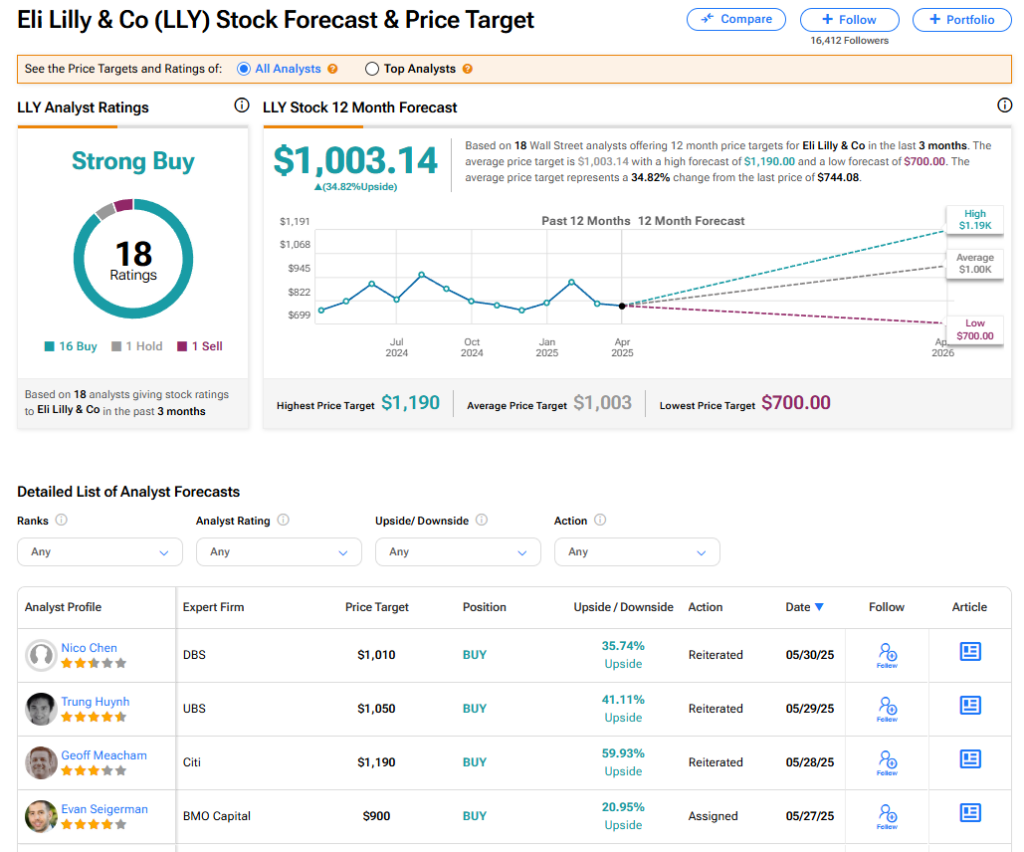

The stock of Eli Lilly has a consensus Strong Buy recommendation among 18 Wall Street analysts. That rating is based on 16 Buy, one Hold, and one Sell recommendations issued in the last 12 months. The average LLY price target of $1,003.14 implies 34.82% upside from current levels.