BMO Capital Markets (BMO) is pounding the table on Eli Lilly’s (LLY) stock to begin the new year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The brokerage firm has reiterated a Buy-equivalent outperform rating on LLY stock with a $1,200.00 price target, which is 12% higher than where the shares currently sit. BMO says it remains confident in Eli Lilly’s global position in the weight-loss drug market and expects the pharma giant to lead in obesity treatments for many years to come.

BMO also highlighted that growth for Eli Lilly’s weight-loss business is supported by broadening access, the upcoming launch of its weight-loss pill called Orforglipron, and the company’s expanding pipeline of new medications to treat conditions ranging from arthritis to Alzheimer’s disease.

Eli Lilly’s Leadership in Weight-Loss Drugs

In a note to clients, BMO said that it expects Eli Lilly to maintain its worldwide leadership position in the weight-loss drug space despite rival Novo Nordisk (NVO) beating it to market with a weight-loss pill. Eli Lilly is currently ramping up production of its weight-loss pill in anticipation of a summer 2026 launch.

The brokerage also noted that Eli Lilly has on deck a highly anticipated new drug to help treat Alzheimer’s disease and lessen its impact on people. BMO says that results from Eli Lilly’s Alzheimer’s medication are eagerly awaited and that the company could have yet another blockbuster drug on its hands.

Is LLY Stock a Buy?

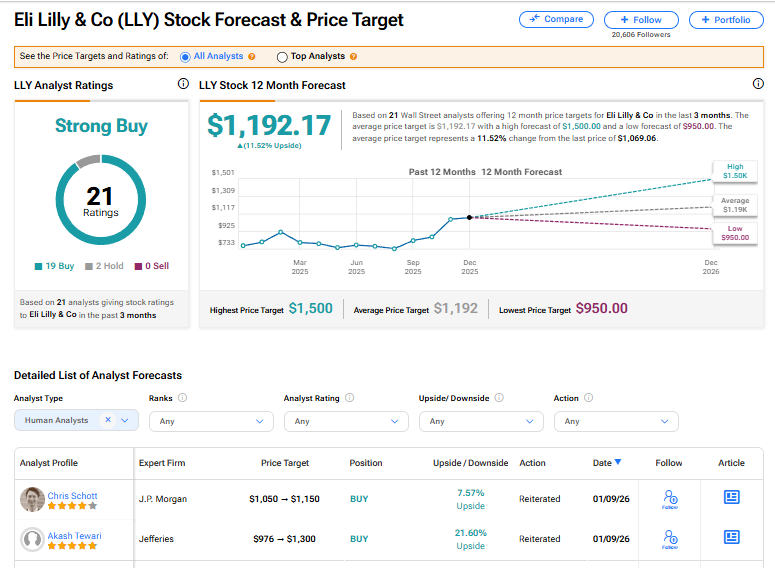

The stock of Eli Lilly has a consensus Strong Buy rating among 21 Wall Street analysts. That rating is based on 19 Buy and two Hold recommendations issued in the last three months. The average LLY price target of $1,192.17 implies 11.52% upside from current levels.