bluebird bio, Inc. (NASDAQ: BLUE) has reported a wider-than-expected loss for the fourth quarter of 2021. It is a biotechnology company that develops gene therapies for severe genetic disorders and cancer.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of the company increased 1% in the extended trading session on Friday after closing about 4% lower on the day.

Results in Detail

For 2021, bluebird reported a loss of $8.16 per share, compared with $9.02 per share in 2020. Net loss from continuing operations came in at $562.6 million, almost in line with the prior year. Revenues reported were $3.7 million.

The company reported a Q4 loss of $1.83 per share against the Street’s loss estimate of $1.82 per share. It recorded a loss of $2.05 per share in the same quarter last year. Net loss from continuing operations stood at $132.3 million, down 2.9%.

Total revenues generated during the quarter stood at $1.6 million. The biotech firm did not report revenue for the prior-year quarter.

Selling, general, and administrative expenses fell 34% year-over-year to $53.2 million, while research and development expenses stood at $79.4 million, up 35%.

As of December 31, 2021, the company’s restricted cash, cash, and cash equivalents and marketable securities balance was around $442 million, including restricted cash of around $46 million.

Pipeline Update

The CEO of bluebird, Andrew Obenshain, said, “2022 is set up to be a landmark year for bluebird bio, with LVV gene therapies for β-thalassemia and cerebral adrenoleukodystrophy under review by the U.S. Food and Drug Administration (FDA) and plans to submit a Biologics License Application (BLA) for lovo-cel for sickle cell disease (SCD) early next year.”

“Underscoring these significant milestones is a continued focus on commercialization and financial discipline to enable the delivery of these transformative therapies to patients and their families,” Obenshain added.

Wall Street’s Take

Overall, the stock has a Hold consensus rating based on 4 Holds and 1 Sell. The average bluebird price target of $12 implies 140% upside potential from current levels. BLUE shares have lost 72.66% over the past year.

Risk Analysis

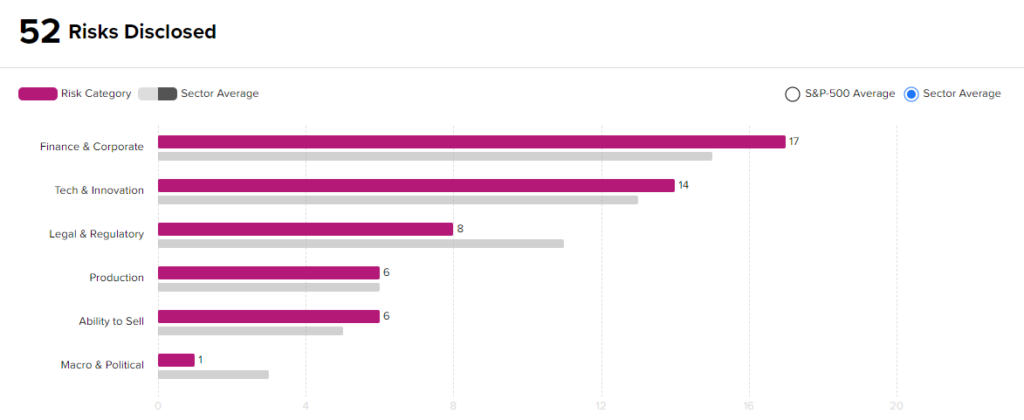

According to the new TipRanks Risk Factors tool, the bluebird stock is at risk mainly from two factors: Finance & Corporate and Tech & Innovation, which contribute 17 and 14 risks, respectively. In total, 52 risks have been identified for the stock.

Bluebird is at a higher risk from a financial and a technical standpoint, than other companies in its industry. Given its higher-risk profile and current stock movements, investors might be wary about investing in this biotech.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Moderna to Open Enterprise Solutions Hub in Atlanta

Amazon Expects FTC’s Verdict on MGM Acquisition by Mid-March: Report

Snowflake Drops 22% on Surprise Quarterly Loss & Disappointing Guidance