Intel (INTC) has finally delivered the kind of news investors have been eagerly waiting for. The semiconductor giant’s third-quarter 2025 results blew past expectations, marking a decisive earnings surprise that signals its costly turnaround strategy is starting to pay off.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As one of the most closely watched reports of the season — and a key indicator for the broader IT sector — Intel’s results propelled its shares toward the $40 mark, extending the stock’s recent upward momentum. Since releasing its Q3 report on October 23, INTC has enjoyed strong bullish momentum, tempered only by a brief pullback at the end of this week.

Yet despite this standout quarter, I’m maintaining my Hold rating on Intel stock. My prior stance was based on major execution risks and an already lofty valuation. While the latest results have largely addressed the execution concerns, the valuation issue has only become more pronounced.

The Jaw-Dropping Q3 That Few Expected

Heading into Intel’s latest earnings call, the market was prepared for disappointment. Management had guided for Q3 non-GAAP earnings per share (EPS) to break even — but Intel didn’t just clear that low bar; it shattered it.

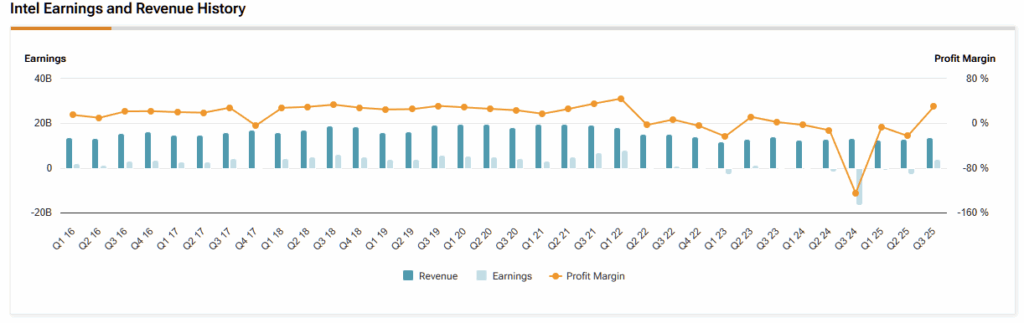

The final Q3 report showed EPS of $0.23, a staggering 2,200% beat over the company’s own forecast, signaling that the business is stabilizing far faster than expected. Revenue also exceeded expectations at $13.7 billion, surpassing the high end of prior guidance.

This strength was fueled by a robust rebound in Intel’s core PC segment and evidence that its aggressive cost-cutting measures, including difficult headcount reductions, are starting to pay off. Notably, the company’s return to a GAAP profit of $0.90 per share underscores that Intel’s long turnaround journey may finally be finding its footing.

Intel’s Turnaround Gains Traction

For me, as a long-term investor, the most significant takeaway from Intel’s Q3 earnings call wasn’t the financial beat — it was the operational progress update. My most considerable hesitation about committing more capital to Intel has always been the uncertainty surrounding the execution of its turnaround plan. The company’s future hinges on reclaiming manufacturing leadership, a goal centered on its next-generation 18A process node, which had reportedly faced troubling yield issues.

CEO Lip-Bu Tan addressed those concerns head-on during his prepared remarks, assuring investors that Intel is seeing “improved execution and steady progress.” He also reminded the market that Intel has already unveiled Panther Lake, its upcoming AI PC processor — and notably, the first client chip to be built on the 18A node.

Crucially, Lip-Bu confirmed that Intel is “on track to bring Panther Lake to market this year,” adding that 18A yields are progressing at a predictable rate and that Fab 52 in Arizona, dedicated to high-volume manufacturing, is now fully operational. This was a powerful de-risking statement. With less than three months left in the year, it strongly suggests Intel’s 18A yield challenges are nearly resolved and are approaching commercial-grade thresholds.

The long-touted technological promise that bulls have clung to is finally moving from PowerPoint slides to production lines at Fab 52 — effectively clearing the largest operational overhang facing Intel’s manufacturing segment. The same positive momentum extends to Intel’s data center roadmap, with its 18A-based Clearwater Forest server chip still on schedule for the first half of 2026.

The PC Tailwind Becomes a Gale

Intel’s Q3 2025 results also highlighted the impact of a powerful external tailwind. Microsoft’s (MSFT) decision to end support for Windows 10 on October 14 has triggered a broad upgrade cycle to Windows 11-compatible systems — a trend clearly reflected in Intel’s latest numbers.

The company’s Client Computing Group (CCG), which produces its PC chips, emerged as the standout performer of the quarter. The segment delivered $8.5 billion in revenue, up 5% year-over-year, with management attributing the strength to a “seasonally stronger market,” “Windows 11-driven refreshes,” and a “stronger pricing mix” as consumers increasingly opt for higher-performance AI PCs.

Notably, strong demand for Intel’s 13th and 14th Gen processors for gaming, along with robust sales of legacy Xeon chips, has led to supply constraints. Intel reportedly raised prices in September and is now prioritizing higher-margin data center products over gaming chips — a sensible move that helped boost gross margins in Q3.

With its core PC business stabilizing and supported by a clear cyclical growth driver, Intel now has the cash flow foundation it needs to continue funding its ambitious — and capital-intensive — turnaround plan.

Data Center Weakness Exposes NVDA-Sized Gap

While Intel’s latest quarterly report was a clear victory for its PC division, it also underscored the company’s most pressing weakness: Intel remains well behind in the artificial intelligence (AI) chip race — and nothing in the Q3 2025 results changed that reality.

The Data Center and AI (DCAI) segment was the lone soft spot in the report, generating $4.1 billion in revenue, down 1% year-over-year. Management highlighted strong demand for Intel’s host CPUs used in AI servers, but ongoing supply constraints limited upside. A key element of Intel’s comeback strategy in this area involves enhancing multithreading performance, yet the segment’s flat results stand in stark contrast to rivals posting explosive AI-driven growth.

Intel’s AI accelerator roadmap also remains a long-term play. Management confirmed that the company’s upcoming “Crescent Island” inference GPU won’t begin customer sampling until the second half of 2026 — signaling that any meaningful revenue capable of challenging Nvidia (NVDA) remains years away.

Is INTC a Good Stock to Buy?

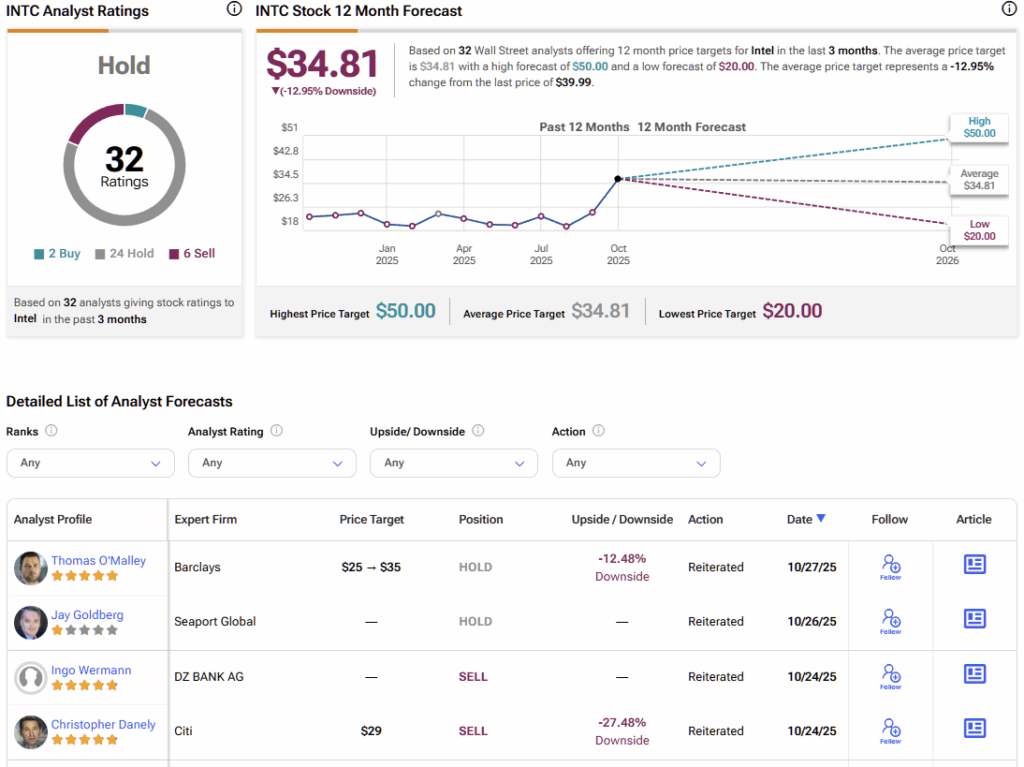

Wall Street attaches a Hold rating on Intel stock, based on 2 Buys, 24 Holds, and 6 Sell ratings issued by analysts during the past three months. The average analyst price target on INTC stock of $34.81 implies about 12% potential downside over the next twelve months.

INTC’s Turnaround is Insufficient to Rouse Stubborn Bulls

Intel’s third-quarter earnings were an undeniable success. Management demonstrated that the turnaround is real — the 18A node is on schedule, the PC business is thriving, and the balance sheet has been bolstered by billions in fresh funding from the U.S. government, SoftBank (SFTBY), and even Nvidia.

Intel’s shares now trade at a trailing P/E of 916x and a forward adjusted P/E of 121.9x, nearly five times the sector median of 25.5x. Despite its still-modest growth profile, Intel commands valuation multiples richer than most of its peers.

My original Hold rating was based on two factors: execution risk and valuation risk. The good news is that execution risk is fading as Intel’s turnaround gains traction. The bad news is that valuation risk has now become the dominant concern. After a 104% year-to-date rally built on optimism about the turnaround, the stock’s current price likely fully reflects that success.

In short, the risk for new investors has shifted — from operational failure to valuation downside. Intel is executing well, but at today’s levels, the stock is too expensive to chase. I’m encouraged by CEO Lip-Bu Tan’s progress, but I’m not willing to pay this steep a premium to add more shares. For now, I’ll continue holding my existing INTC position.