Shares of the leading payment and fintech company Block (NYSE:SQ) have underperformed the broader markets this year. Ahead of its Q2 earnings report, KBW analyst Vasundhara Govil lowered her price target to $74 from $82 on July 7. Govil reiterated a Hold rating on Block stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company is expected to release its second-quarter financials on Thursday, August 1.

Reason for the Price Target Adjustment

Govil noted that the payments sector is under pressure due to weaker consumer spending trends. As a result, she decreased the price target to $74 per share.

The analyst added that market participants will closely analyze Block’s Q2 earnings results amid ongoing macro uncertainty.

Block Begins 2024 on Solid Footing

Despite challenges, Block started 2024 on a positive note, surpassing analyst expectations for both revenue and earnings. This beat reflects the strength of its payment app and the success of its cost-reduction efforts.

Consequently, Block increased its 2024 outlook. It now expects adjusted EBITDA of $2.76 billion, up from $2.63 billion. Further, its adjusted operating income is expected to reach $1.3 billion, compared to its previous guidance of $1.15 billion.

With this backdrop, let’s delve into the Street’s forecast for Block’s Q2.

Block: Q2 Expectations

Wall Street expects Block to report sales of $6.27 billion in the second quarter of 2024, up about 13% year-over-year. The increase in financial services-related products and higher Gross Payment Volume (GPV) will likely support Block’s top-line growth rate.

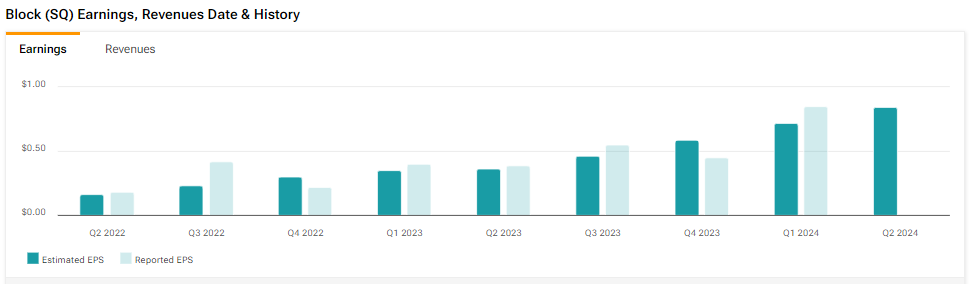

Analysts expect Block to generate earnings of $0.84 per share in Q2, up about 115% year over year. Higher revenue and a focus on improving cost efficiency will likely boost Block’s gross profit dollars and earnings per share.

It’s worth noting that Block has surpassed analysts’ earnings estimates six times in the past eight quarters.

Is Block a Buy or Sell?

Wall Street is cautiously optimistic about Block’s prospects ahead of Q2 earnings. With 23 Buys, six Holds, and one Sell recommendation, Block stock has a Moderate Buy consensus rating. Analysts’ average price target on SQ stock is $89.33, which implies 35.8% upside potential from current levels.