Penny stock Blink Charging (NASDAQ:BLNK) declined more than 7% in the extended trading session yesterday after the company reported mixed results for the Fiscal fourth quarter. Nevertheless, BLNK reported a reduced loss in Q4 due to lower operating expenses.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BLNK provides electric vehicle (EV) charging equipment and networked charging solutions.

Q4 Financial Highlights

The company reported a loss per share of $0.28 in Q4, lower than the analysts’ expectations of a loss of $0.31 per share. Also, it compared favorably with a loss of $0.55 in the year-ago quarter. Blink’s bottom-line performance benefitted from a 16% decline in operating expenses, driven primarily by lower compensation costs.

Meanwhile, revenue increased 89% year-over-year to $42.7 million but came below the consensus estimates of $35.45 million. The year-over-year growth was driven by strong demand for BLNK’s charging equipment and services.

2024 Outlook

For the full year 2024, Blink expects to report revenues between $165 million and $175 million, reflecting an increase of about 20% from the midpoint.

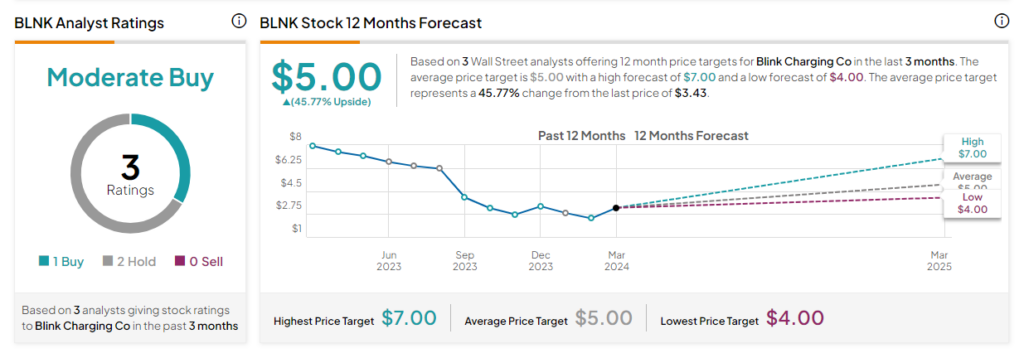

Following the release of Q4 results, one analyst, Gabriel Daoud of TD Cowen, maintained a Buy rating on BLNK stock with a price target of $4, implying a 16.6% upside potential. The analyst believes that the strength in hardware sales coupled with higher service revenue should drive the company’s top-line growth.

Is Blink Stock a Good Buy?

On TipRanks, Blink Charging has a Moderate Buy consensus rating based on one Buy and two Hold ratings. Also, the analysts’ average price target on BLNK stock of $5 implies a 45.77% upside potential. Shares of the company have declined by about 56% in the past year.