Electric vehicle charging equipment and software services provider Blink Charging Co. (NASDAQ: BLNK) recently revealed the expansion of its international footprint in Greece and the Latin American region.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of the company declined 3.5% on Thursday to close at $24.16.

In terms of software enhancements, Blink has onboarded all hardware and EV driver members from its Greek joint venture, Blink Charging Hellas, to the Blink Network. This onboarding will enable the addition of 210 EV chargers in Greece to the Blink Network, ensuring a seamless charging experience for drivers.

In the Latin American region, due to the increasing demand witnessed for EV charging infrastructure, Blink has signed a number of reseller and distribution agreements with local partners to provide Blink hardware and software across the region.

Stock Rating

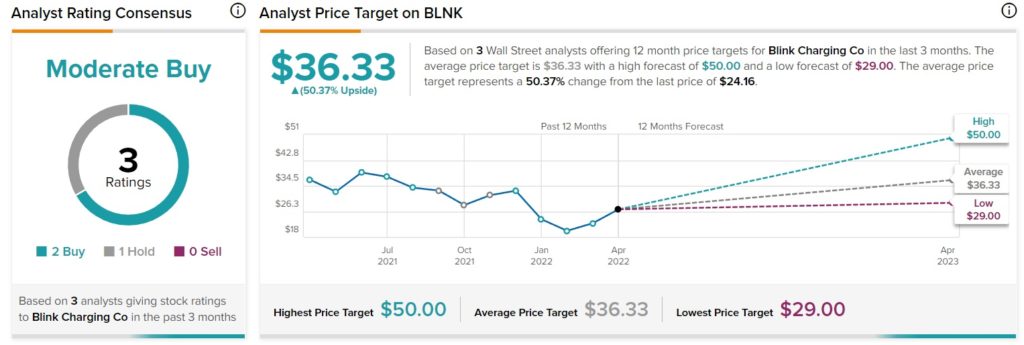

Consensus among analysts is a Moderate Buy based on two Buys and one Hold. BLNK’s average price target of $36.33 implies upside potential of 50.4% from current levels. Shares have declined 28.4% over the past year.

Conclusion

The adoption of electric vehicles and the corresponding need for charging infrastructure is witnessing growth by the day. In such a scenario, Blink’s move to enhance its international presence, especially in the burgeoning Latin American markets, is likely to be beneficial for the company.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

State Street Shares Tank 8.5% Despite Q1 Beat

Citigroup Outperforms with Q1 Earnings & Revenue Beat

Wells Fargo Drops on Disappointing Revenues, Fee Income Falters