Blackstone (NYSE:BX) stock gained 2.4% on Thursday after the company released fourth-quarter results. BX delivered strong performance in the reported quarter, benefiting from higher inflows, a rise in assets under management (AUM), and lower expenses.

Blackstone is a global investment firm specializing in alternative asset management.

Q4 Earnings in Detail

Blackstone reported distributable earnings of $1.11 per share, up 3.7% year-over-year, and surpassed the Street’s estimate of $0.95. The increase can be attributed to a 12% decline in expenses to $941.6 million.

Similarly, Q4 segment revenues increased 8% year-over-year to $2.54 billion and came above the analysts’ expectations of $2.46 billion. The topline growth was driven by a rise in net management and advisory fees.

As of December 31, 2023, total AUM stood at $1.04 trillion, up 7% year-over-year, with fee-earning AUM increasing by 6%. Furthermore, the company recorded inflows of $52.7 billion in the quarter and $148.5 billion for the full year 2023.

In the fourth quarter, Blackstone witnessed robust performance in corporate private equity and private credit strategies. Liquid credit and hedge fund solutions also generated decent returns. Nevertheless, the overall performance of the real estate funds was negatively impacted by redemption requests from the Blackstone Real Estate Income Trust (BREIT).

Capital Deployment

Blackstone declared a quarterly common dividend of $0.94 per share, up 17.5% from the previous payout. The dividend will be paid on February 12 to shareholders of record on February 5.

Interestingly, BX stock currently has a dividend yield of 2.79%, which compares favorably with the financial sector’s average of 2.11%.

Is BX a Good Stock to Buy?

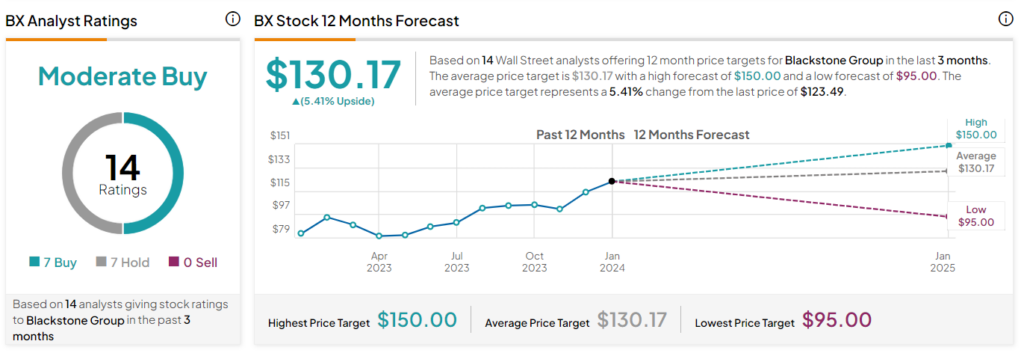

Overall, the Street has a Moderate Buy consensus rating on Blackstone stock. The average BX price target of $130.17 implies a 5.4% upside potential from the current level. Shares have gained 35% over the past three months.