BlackRock (BLK), the world’s largest asset manager, is taking steps to bolster its position in the European market. The company aims to expand its retail product offerings, such as exchange-traded funds (ETFs), in the region.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This strategic move comes as the company faces rising competition from other asset managers like Amundi and Vanguard, who have been growing their assets at a faster pace in recent years.

To stay ahead, BlackRock is focusing on European equity markets, which many investors view as undervalued compared to U.S. equities.

Importantly, BLK aims to double its customer base in Europe in the next three years.

BLK to Capitalize on Europe’s Investment Shift

BlackRock’s strategy includes launching more bond and actively managed ETFs, as well as targeted indices that track specific sectors or themes. Also, BLK is looking to launch a bitcoin (BTC) ETF in Europe, following the success of such products in the U.S.

To expand its reach, the company plans to partner with local banks to expand its range of investment products. These collaborations aim to meet the growing demands of first-time investors in Europe, which is witnessing a shift from a savings-focused mindset to an investment-driven one.

BlackRock’s €3.5B European Expansion

As part of its strategy to strengthen its foothold in Europe, BLK recently joined hands with Allianz (ALIZY) and T&D Holdings (TDHOF) to acquire Viridium Group, a European life insurance consolidation platform for about €3.5 billion.

This deal will help BLK diversify its investment portfolio and strengthen its presence in the European life insurance market, a sector with major growth potential.

Is BLK a Good Stock to Buy?

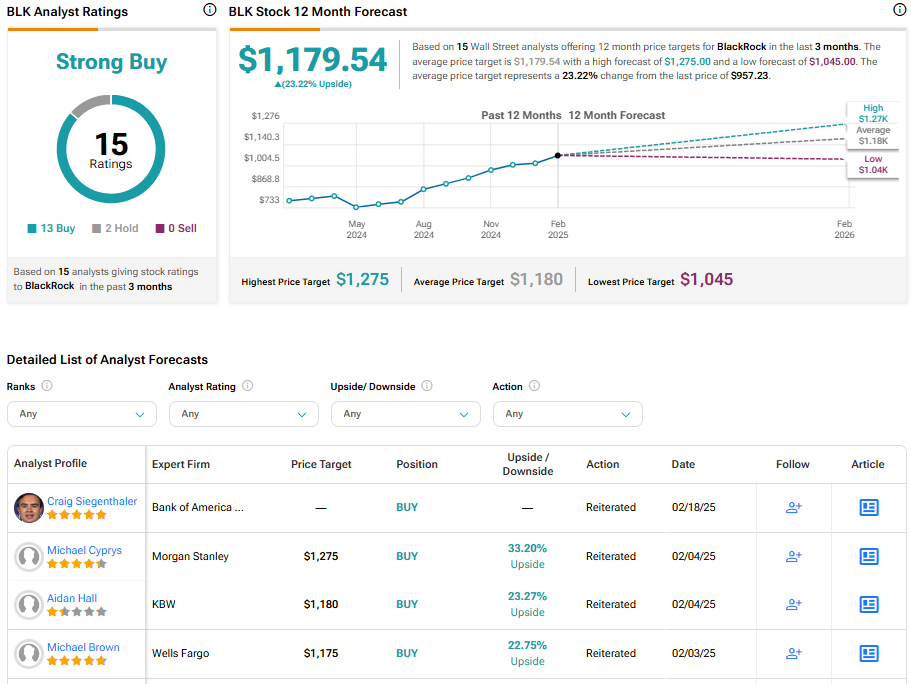

Turning to Wall Street, BLK stock has a Strong Buy consensus rating based on 13 Buys and two Holds assigned in the last three months. At $1,179.54, the average BlackRock price target implies a 23.22% upside potential. Shares of the company have gained 4.1% over the past six months.