CK Hutchison has been urged to “think twice” about its $22.8 billion Panama Ports deal with U.S. asset manager BlackRock (BLK) because it betrays the Chinese people.

CK Accused of Being Spineless

According to the Financial Times, a strongly worded commentary in a government-backed newspaper has slammed Hong Kong-based conglomerate CK Hutchison for “disregarding the national interest.” It added that the motive behind the deal was “spineless, grovelling and profit-seeking.”

It was announced last month that under an in-principle agreement, 43 ports owned by billionaire Li Ka-shing’s CK Hutchison, including two at either end of the Panama Canal, will be sold to a consortium including BlackRock. The asset manager would buy a 90% interest in the Panama Ports Company alongside Global Infrastructure Partners and container terminal group Terminal Investment. Panama Ports owns and operates the ports of Balboa and Cristobal within Panama.

The Chinese article said that the U.S. Government had pushed for the deal “through despicable means” and that it would hit China’s shipping and trade interests.

BlackRock Stays Strong

The tirade may put the completion of the deal in doubt, but investors in BlackRock didn’t seem too concerned with its stock climbing higher in pre-market trading. President Trump has put a lot of political capital into ensuring that U.S. dominance over the Panama Canal is reasserted, so the pressure on reaching a successful conclusion will be significant.

Trump has frequently claimed that the canal is really being run by China, claims that Panama President Jose Raul Mulino has denied.

Is BLK a Good Stock to Buy Now?

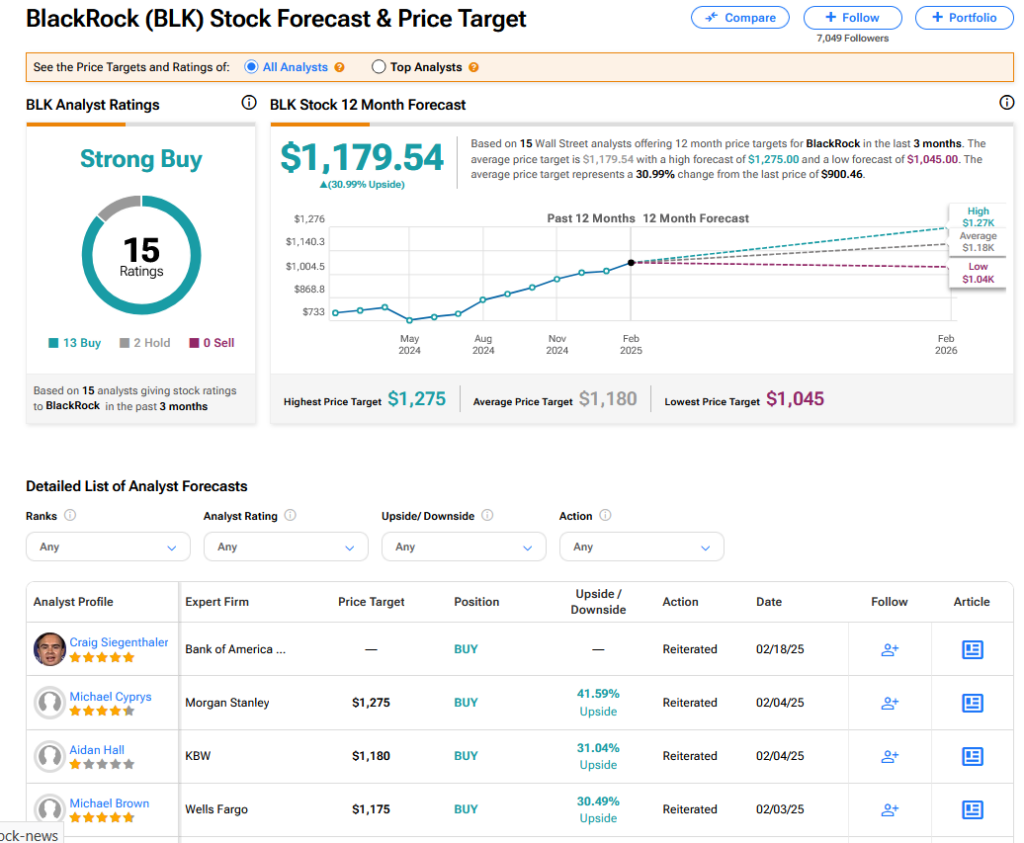

On TipRanks, BLK has a Strong Buy consensus based on 13 Buy and 2 Hold ratings. Its highest price target is $1,275. BLK stock’s consensus price target is $1,179.54 implying an 30.99% upside.

Questions or Comments about the article? Write to editor@tipranks.com