The idea that, somewhere, some hacker could shut down our water, power, or other vital infrastructure by remote is the stuff of nightmares for many. And cybersecurity firm BlackBerry (TSE:BB) showed us just how vulnerable these systems were with a report about how many attacks hit in the third quarter of 2024. The news was unsettling, and investors sent BlackBerry stock up nearly 2.5% in Thursday morning’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The report was disturbing for a range of reasons. The most immediate is the bottom line number: 600,000 attacks were detected on critical infrastructure systems just between July 2024 and September 2024. Nearly half of these, 45%, were specifically targeting the financial sector, reports noted. Further, nearly three out of four attacks, 430,000 total, were specifically aimed at “commercial enterprise industries.”

The numbers were distressing alone, but the report went on from there. It also analyzed the various groups involved in launching such attacks, as well as considering their methods as well as motivations. As a result of the new report, noted a report from Sherwood News, BlackBerry shares ultimately hit a multi-year high after the report came out Wednesday.

But What to Do About It?

Thankfully, BlackBerry did not stop at just telling everyone what was wrong. It also offered key suggestions on how to put up a defense against such things. This included offering tips on how to protect individual devices, as well as how to engage in “secure communications practices.”

The report showed that the key targets right now are the Americas, particularly North and Latin, though not far behind were the Asia-Pacific region (APAC)) and the Europe, Middle East and Africa (EMEA) corridor. Deepfake threats were on the rise, the report noted, as were scams powered by artificial intelligence.

Is BlackBerry a Good Stock to Buy?

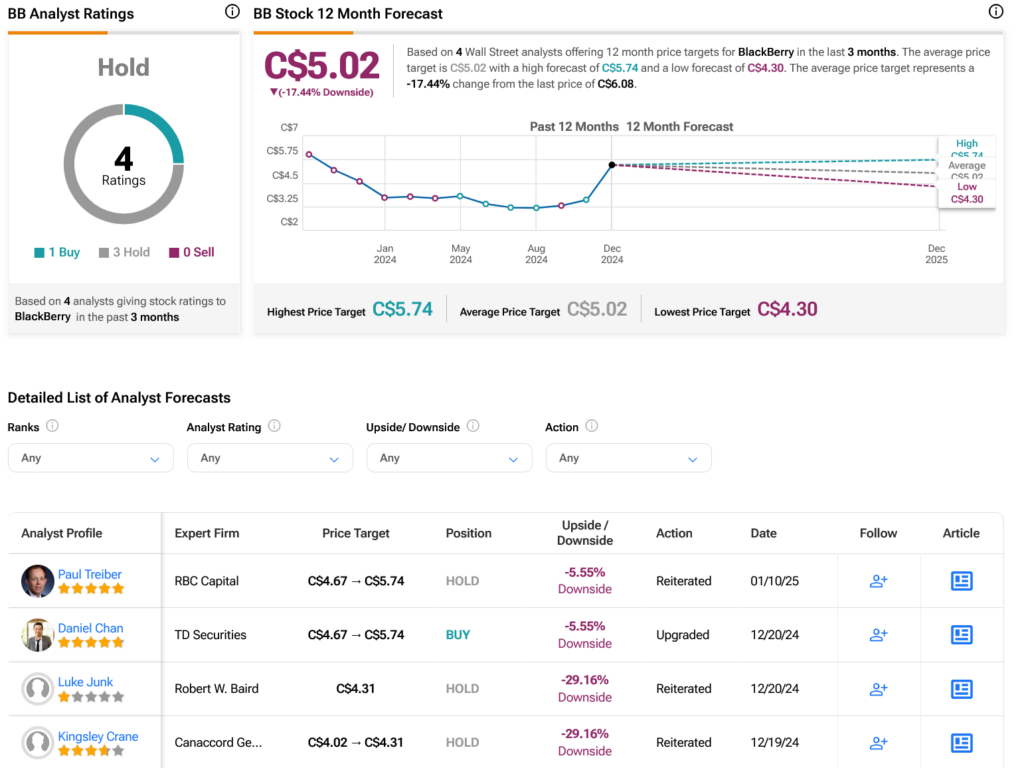

Turning to Wall Street, analysts have a Hold consensus rating on TSE:BB stock based on one Buy and three Holds assigned in the past three months, as indicated by the graphic below. After a 33.92% rally in its share price over the past year, the average TSE:BB price target of C$5.02 per share implies 17.44% downside risk.