Software company BlackBerry (NYSE:BB)(TSE:BB) is streamlining its cost structure to achieve profitability. The plan includes more job cuts, which should generate annual savings of approximately $27 million. BB stock is up about 1.8% in Monday’s after-hours trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Through a combination of cost reduction initiatives and margin expansion plans, the company targets $100 million in annualized net profit improvements. This is in addition to the $50 million of annualized cost-saving actions announced in the previous quarter, primarily focused on the Cybersecurity business.

Furthermore, the corporation declared that it is progressing well in creating autonomous divisions for its Internet of Things (IoT) and Cybersecurity businesses. Notably, during the Q3 conference call in December 2023, the company announced its plans to create these two independent units as part of its strategy to optimize cost structures and bolster shareholder value.

BlackBerry Aims to Turn Cash Flow Positive

BlackBerry’s operating cash usage was $56 million in Q2. Further, it showed sequential improvement in Q3 of the current Fiscal year and was $31 million. The company remains optimistic and expects a further sequential reduction in operating cash usage in the fourth quarter.

Given the company’s cost-reduction actions and operating efficiencies, BlackBerry expects to turn cash flow positive in the fourth quarter of Fiscal 2025.

Notably, the company recently secured long-term financing by issuing $200 million worth of convertible senior notes and plans to repay $150 million of short-term debentures through the net proceeds. This repayment will reduce its debt by 45% compared to November 2023 levels and strengthen its balance sheet.

Is BlackBerry a Buy, Sell, or Hold?

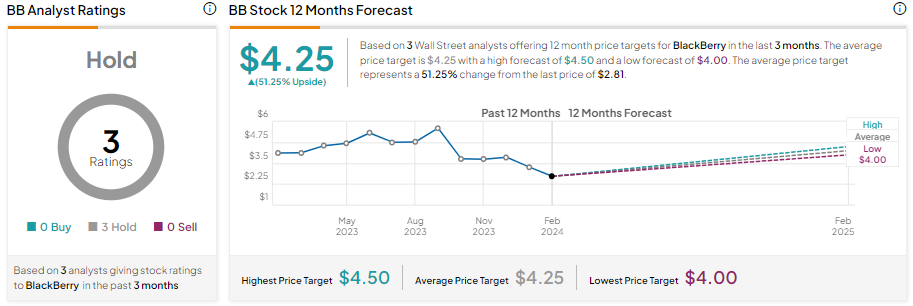

This penny stock (learn more about penny stocks here) is down about 33% in one year. Despite this notable drop in its value, Wall Street remains sidelined.

Three analysts cover BB stock, and all recommend a Hold, translating into a Hold consensus rating. Analysts’ average price target of $4.25 implies 51.25% upside potential from current levels.