Canadian security software and services company BlackBerry Limited (TSE:BB) (NYSE:BB) released its Fiscal Q2-2024 earnings results for the period ending August 31, 2023. Earnings per share of -$0.04 beat expectations of -$0.07 and were slightly better than last year’s figure of -$0.05. Meanwhile, revenue of $132 million (down 21.4% year-over-year) came up short of the $134.7 million forecast. Blackberry’s IoT segment generated $49 million in sales, and its Cybersecurity segment contributed $79 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Please note: all figures are in U.S. dollars unless otherwise stated.

Despite lacking profitability, the company remains optimistic about the future. CEO John Chen expressed confidence in the company’s IoT ventures and is enthusiastic about its upcoming QNX® Software Development Platform 8.0. He expects “a strong finish for IoT revenue this fiscal year, with the fourth quarter forecasted to be the strongest ever” and a strong second half of the fiscal year regarding its Cybersecurity business.

Is BlackBerry Stock a Buy, According to Analysts?

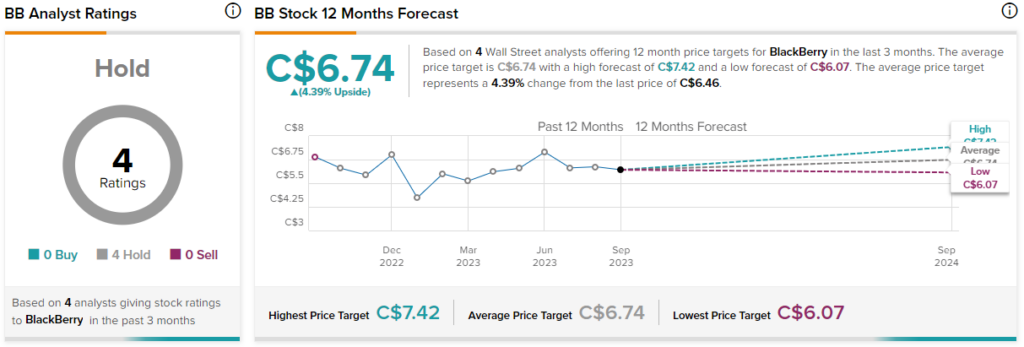

According to analysts, BB stock comes in as a Hold based on two unanimous Hold ratings assigned in the past three months. The average BB stock price target of C$6.74 implies just 4.4% upside potential.