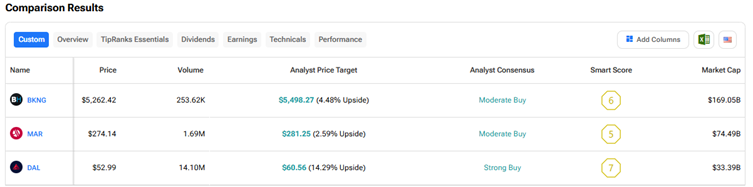

Travel stocks, including airlines, hotels, and online booking platforms, took a major hit when the Trump administration announced steep tariffs and sparked fears of a potential recession. While recent results reflected the impact of macro pressures amid trade wars on travel demand, several travel companies continue to deliver resilient performance despite ongoing challenges. Moreover, many stocks have recovered to some extent following the easing of tariff pressures. Using TipRanks’ Stock Comparison Tool, we placed Booking Holdings (BKNG), Marriott International (MAR), and Delta Air Lines (DAL) against each other to find the most attractive travel stock, according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Booking Holdings (NASDAQ:BKNG)

Online travel platform Booking Holdings delivered upbeat Q1 results despite ongoing uncertainty. Moreover, the company’s Q2 outlook and full-year revised guidance were better-than-feared. The company’s performance reflected the resilience of its business model compared to its rivals.

Also, BKNG’s massive scale, superior margins, and an experienced management team are expected to ensure long-term growth. Additionally, the company is expected to gain from multi-year strategic investments in connected trips, payments, generative AI, and other growth areas.

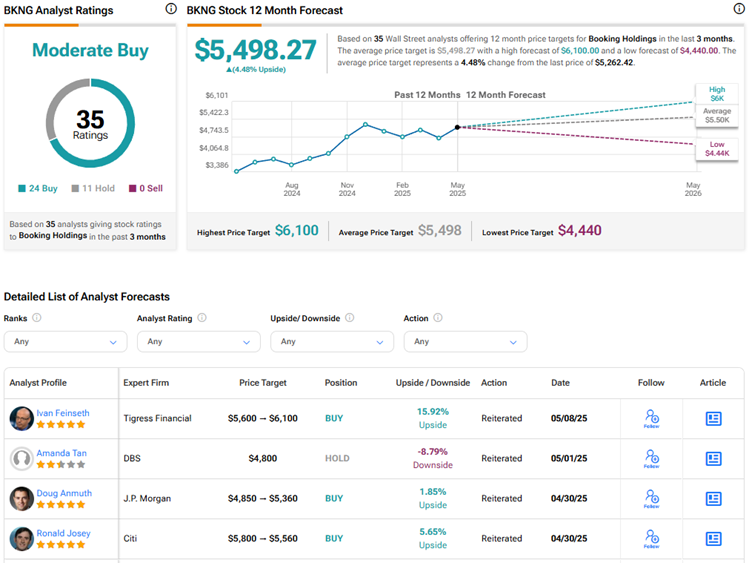

What Is the Price Target for BKNG Stock?

In reaction to the Q1 2025 results, JPMorgan analyst Doug Anmuth increased the price target for Booking Holdings stock to $5,360 from $4,850 and reiterated a Buy rating. Anmuth noted that BKNG has experienced stable levels of global leisure travel demand so far in 2025 and healthy growth in forward bookings. However, the company saw a decrease in length of stay and some strain at the lower end of the consumer spectrum. No such trends were observed in Europe. Overall, the company has not seen any signs of a macro-driven slowdown at the global level, which Anmuth believes reflects the benefit of its geographically diversified platform.

That said, the analyst noted that BKNG is taking greater macroeconomic uncertainty into account in its full-year outlook by widening gross bookings and revenue growth outlook ranges at the low end. Overall, Anmuth has confidence in Booking Holdings’ solid execution and its ability to drive multi-year double-digit percentage EPS growth. He concluded that BKNG is best positioned within online travel amid an uncertain macro backdrop.

Overall, Wall Street has a Moderate Buy consensus rating on Booking Holdings stock based on 24 Buys and 11 Holds. The average BKNG stock price target of $5,498,27 implies about 5% upside potential. BKNG stock has risen about 6% year-to-date.

Marriott International (NASDAQ:MAR)

Hotel operator Marriott International reported upbeat results for the first quarter of 2025, with revenue growth of 5% reflecting robust business in international markets, particularly in Asia Pacific (excluding China). The company stated that following stronger-than-anticipated trends in January and February, demand in the U.S. softened in March, essentially due to a 10% year-over-year fall in U.S. government RevPAR (revenue per available room).

Further, Marriott, which owns brands like Ritz-Carlton, Sheraton, and Courtyard, missed Q2 earnings guidance expectations and cautioned that visibility into the second half of the year is low due to a short booking window, indicating increased uncertainty and caution in spending on travel.

Also, Marriott reduced its full-year outlook for RevPAR growth by 50 basis points to the range of 1.5% to 3.5%, compared to the prior estimate of 2% to 4%, to reflect a continued decline in the U.S. government demand due to spending cuts.

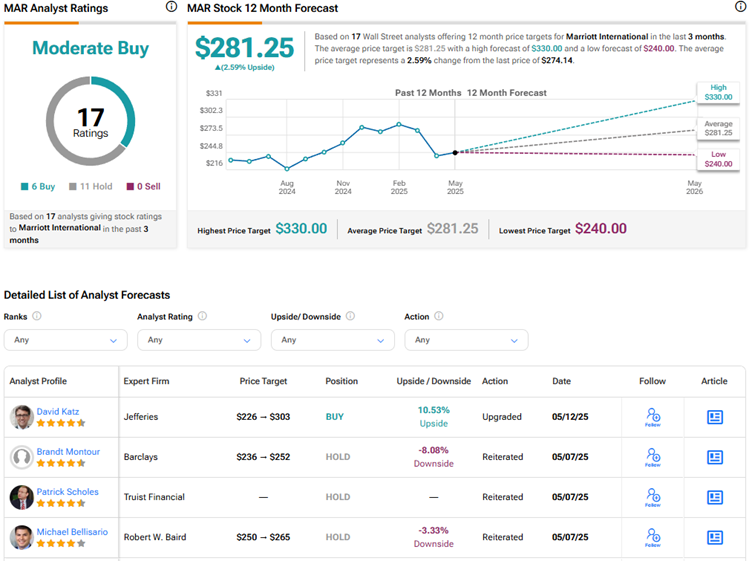

Is MAR Stock a Buy, Sell, or Hold?

Following the Q1 print, BMO Capital analyst Ari Klein increased the price target for Marriott International stock to $265 from $250 but maintained a Hold rating. Klein stated that the company delivered robust Q1 results, backed by strength in its international markets. He added that while U.S. and Canada demand softened in March, it was mainly due to weakness in government and select-service businesses, with minimal impact on group and full-service.

While Q2 guidance was light, Klein noted that Marriott’s full-year outlook was only slightly adjusted, with EBITDA moderated by $10 million and EPS outlook intact. Moreover, he observed that Marriott’s 50 basis points 2025 RevPAR growth outlook reduction was less than Hilton’s (HLT) 150 basis points cut, likely indicating the company’s lower select-service and higher international exposure. That said, Marriott’s estimates are valid only if current demand holds, with downside risk if the macro environment deteriorates further.

Currently, Wall Street has a Moderate Buy consensus rating on Marriott International stock based on six Buys and 11 Holds. The average MAR stock price target of $281.25 indicates a modest upside potential of 2.6%. MAR stock is down about 2% so far in 2025.

Delta Air Lines (NYSE:DAL)

Delta Air Lines reported better-than-expected earnings for the first quarter of 2025, reflecting the resilience of its business model. The company attributed its March top-line growth to its diverse revenue streams, with continued strength in premium, loyalty, and international revenues, offsetting Domestic and main cabin softness.

The company highlighted that the year is turning out to be different than what it had expected at the start, as tariff wars have impacted consumer sentiment. Given the ongoing uncertainty, Delta said that it is reducing capacity growth in the second half of the year and taking additional cost management actions. Nonetheless, the company believes that it is well-positioned to deliver strong profitability and free cash flow in 2025.

Is DAL Stock a Good Buy?

Following the Q1 print, Citi analyst Stephen Trent reiterated a Buy rating on Delta Air Lines stock with a price target of $72. The 5-star analyst noted that Delta’s Q1 results indicated that it is a carrier with a resilient business model, given its upbeat performance despite significant uncertainties around demand and the global tariff woes.

He noted that Delta generated $1.3 billion in free cash flow in Q1 2025 and expects a double-digit EBIT (earnings before interest and taxes) margin in the second quarter.

With 13 Buys and three Holds, Delta Air Lines stock scores a Strong Buy consensus rating on TipRanks. The average DAL stock price target of $60.56 implies 14.3% upside potential. DAL stock has declined 12.4% year-to-date.

Conclusion

Wall Street is bullish on Delta Air Lines stock and cautiously optimistic on Booking Holdings and Marriott International stocks. Analysts see higher upside potential in DAL stock than in the other two travel stocks. They are confident about Delta Air Lines’ ability to navigate short-term challenges, backed by its strong execution and diverse revenue streams.